Agentic AI in Banking: Automate Operations & Ensure Compliance

Deploy no-code AI agents that provide verifiable, source-cited answers from your banking knowledge base. Automate customer service and internal operations while maintaining regulatory compliance.

Trusted by businesses worldwide

Why Banks Choose Agentic AI Solutions

Banking institutions face unique challenges balancing innovation with strict regulatory requirements. Wonderchat's AI platform delivers both, enabling financial organizations to automate complex processes while maintaining verifiable accuracy. Our platform ingests your banking policies, procedures, and knowledge base to create intelligent AI agents that provide attributed answers - eliminating hallucinations and ensuring compliance. With 24/7 automated support, banks can reduce operational costs while enhancing customer service across digital channels.

Emily

AI Agent

Wonderbot

Welcome to Wonderchat! How can I help you today?

hey i’d like to upgrade to enterprise please

Wonderbot

Sure, please hold on for a second.

Retrieving account details...

Retrieving account details...

Please confirm that you would like to upgrade to Wonderchat Enterprise. Your Visa card ending in 1234 will be charged $480.00 a year.

Cancel

Upgrade

Message...

Easy 5 minute set-up

How Wonderchat Works

Regulatory Confidence

Enterprise-Grade Compliance & Security

Deploy AI agents that meet banking's strict regulatory standards with SOC 2 and GDPR compliance built-in. Ensure all AI responses are verifiable with source attribution to maintain audit trails.

Source-attributed answers

SOC 2 compliance

Secure data handling

Regulatory Confidence

Enterprise-Grade Compliance & Security

Deploy AI agents that meet banking's strict regulatory standards with SOC 2 and GDPR compliance built-in. Ensure all AI responses are verifiable with source attribution to maintain audit trails.

Source-attributed answers

SOC 2 compliance

Secure data handling

Regulatory Confidence

Enterprise-Grade Compliance & Security

Deploy AI agents that meet banking's strict regulatory standards with SOC 2 and GDPR compliance built-in. Ensure all AI responses are verifiable with source attribution to maintain audit trails.

Source-attributed answers

SOC 2 compliance

Secure data handling

Banking Knowledge Integration

Train AI on Banking Documentation

Rapidly build AI agents that understand your specific banking policies, procedures, and products by training them on your institutional knowledge base, websites, and documentation.

Policy document ingestion

Multiple file formats

Continuous updates

Banking Knowledge Integration

Train AI on Banking Documentation

Rapidly build AI agents that understand your specific banking policies, procedures, and products by training them on your institutional knowledge base, websites, and documentation.

Policy document ingestion

Multiple file formats

Continuous updates

Banking Knowledge Integration

Train AI on Banking Documentation

Rapidly build AI agents that understand your specific banking policies, procedures, and products by training them on your institutional knowledge base, websites, and documentation.

Policy document ingestion

Multiple file formats

Continuous updates

Customer Service Automation

Handle Banking Queries 24/7

Automate responses to common banking questions about account services, loan applications, and financial products, providing instant, accurate information while reducing support costs.

24/7 customer service

Multi-language support

70% query deflection

Customer Service Automation

Handle Banking Queries 24/7

Automate responses to common banking questions about account services, loan applications, and financial products, providing instant, accurate information while reducing support costs.

24/7 customer service

Multi-language support

70% query deflection

Customer Service Automation

Handle Banking Queries 24/7

Automate responses to common banking questions about account services, loan applications, and financial products, providing instant, accurate information while reducing support costs.

24/7 customer service

Multi-language support

70% query deflection

5-minute set up with our native integration

Deploy Agentic AI for Your Banking Institution

1

Create your AI chatbot – Pick the perfect AI model fit for your support needs.

2

Train AI with Docs, FAQs & Policies – Upload knowledge base files and site links.

3

Customise Workflows & Escalation Rules – AI handles what it can, and escalates what it can’t.

4

Monitor & Optimise with Analytics – See where customers get stuck and fine-tune responses.

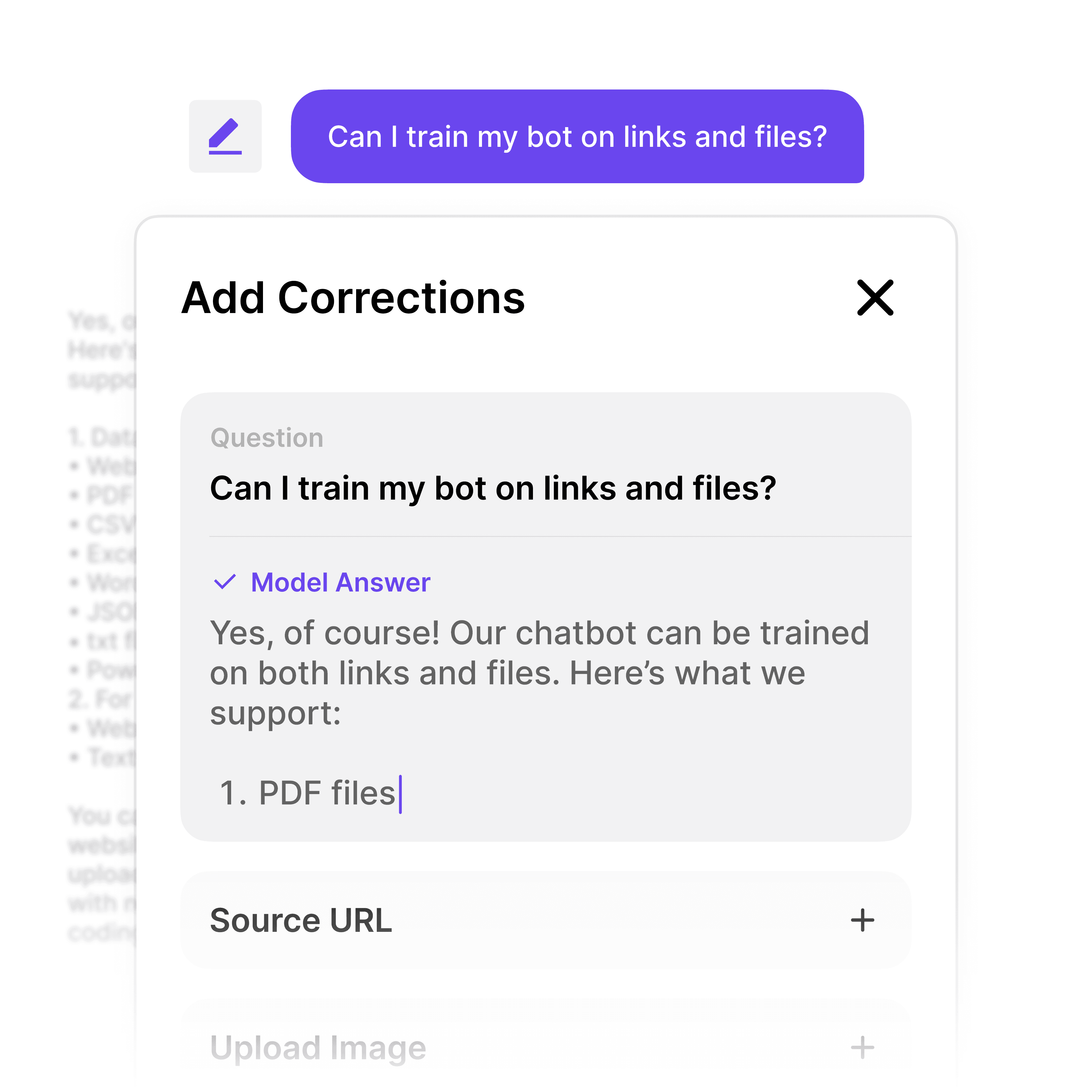

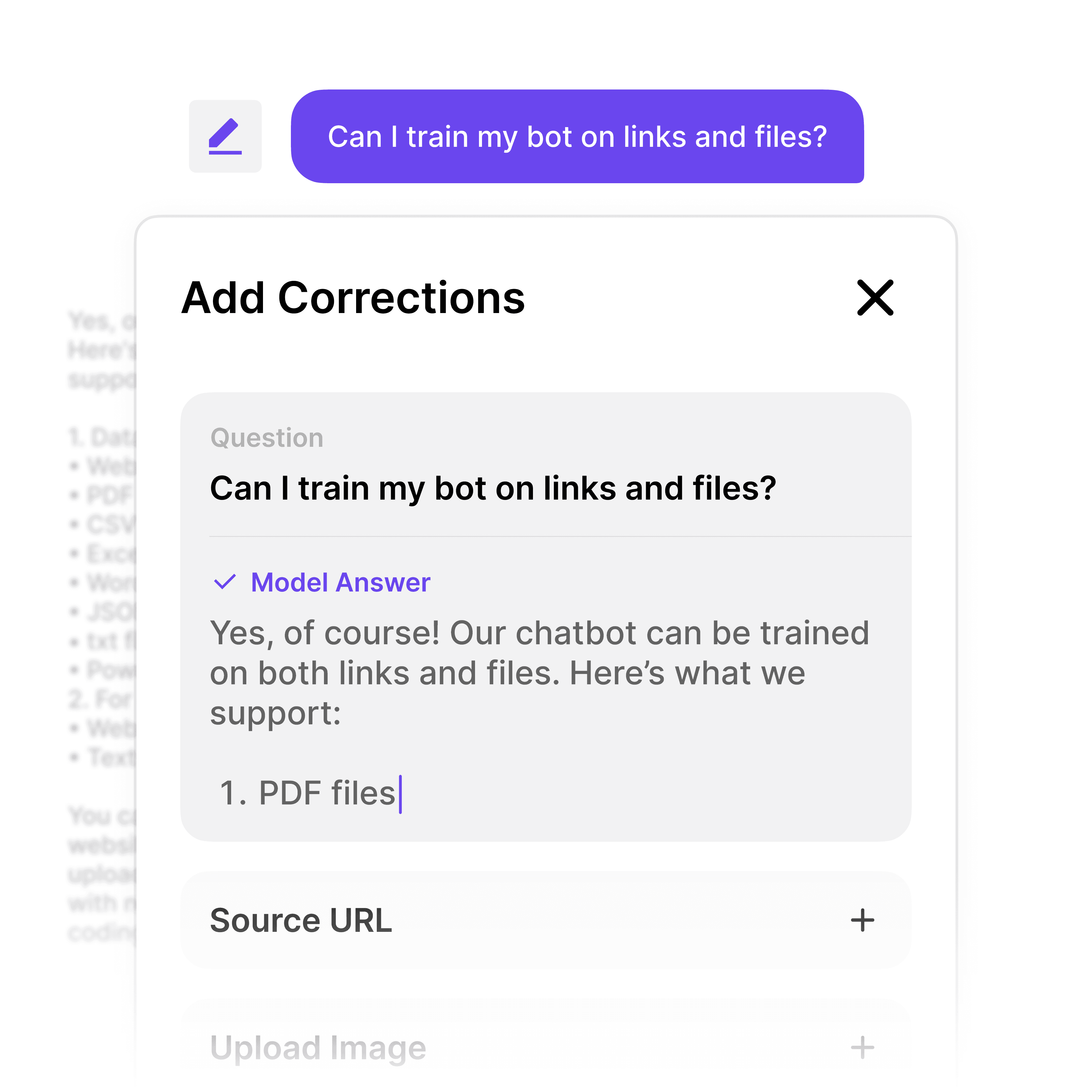

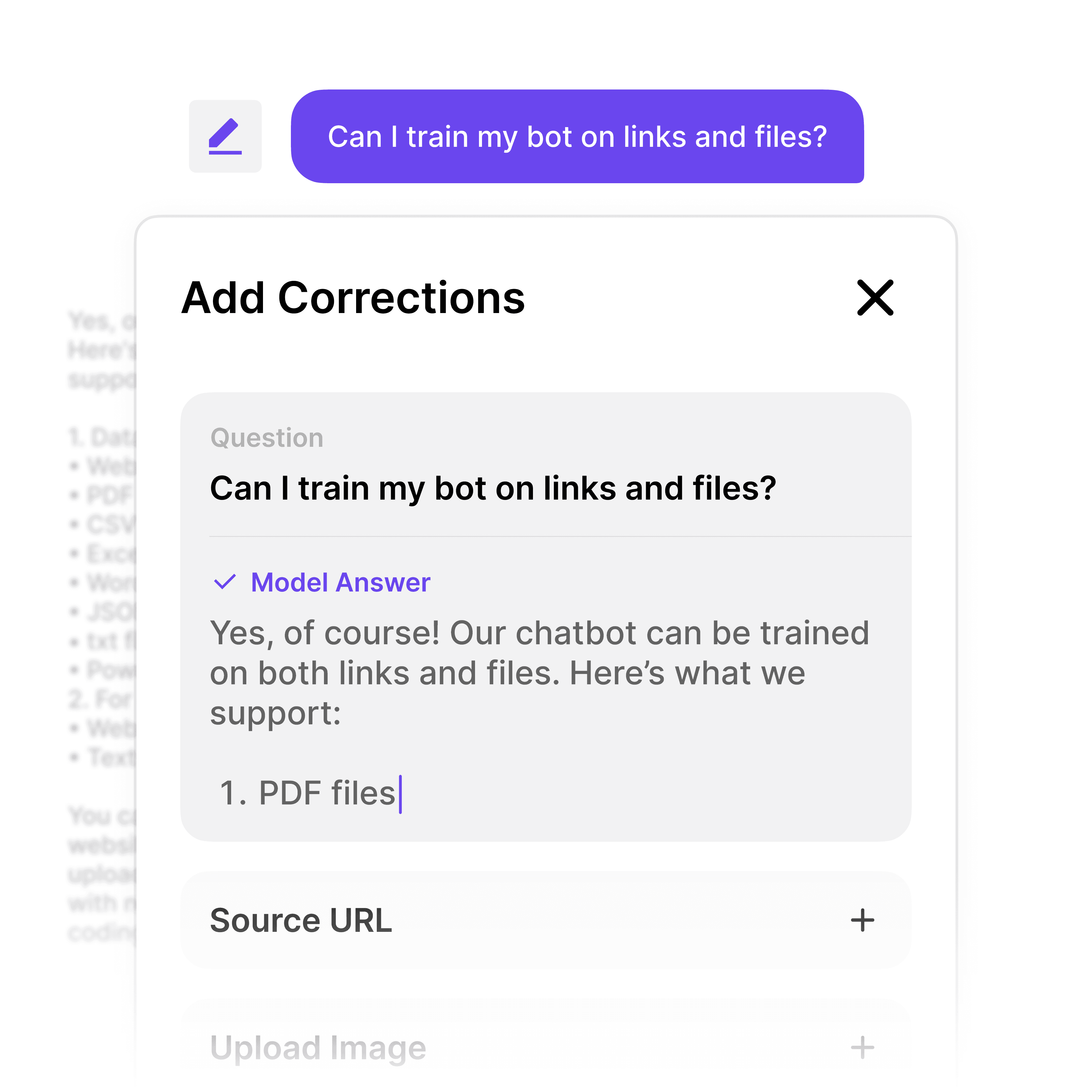

Accuracy Assurance

Continuous Learning & Verification

Ensure your banking AI delivers only accurate information with built-in verification and correction tools. Eliminate AI hallucinations with source attribution for every response.

Verifiable responses

Continuous improvement

Error prevention

Accuracy Assurance

Continuous Learning & Verification

Ensure your banking AI delivers only accurate information with built-in verification and correction tools. Eliminate AI hallucinations with source attribution for every response.

Verifiable responses

Continuous improvement

Error prevention

Accuracy Assurance

Continuous Learning & Verification

Ensure your banking AI delivers only accurate information with built-in verification and correction tools. Eliminate AI hallucinations with source attribution for every response.

Verifiable responses

Continuous improvement

Error prevention

Banking Process Automation

Automate Complex Banking Workflows

Build structured conversational flows to guide customers through loan applications, account openings, and other complex banking processes while ensuring compliance at every step.

Guided processes

Compliance checkpoints

Reduced manual work

Banking Process Automation

Automate Complex Banking Workflows

Build structured conversational flows to guide customers through loan applications, account openings, and other complex banking processes while ensuring compliance at every step.

Guided processes

Compliance checkpoints

Reduced manual work

Banking Process Automation

Automate Complex Banking Workflows

Build structured conversational flows to guide customers through loan applications, account openings, and other complex banking processes while ensuring compliance at every step.

Guided processes

Compliance checkpoints

Reduced manual work

40+ Languages

Starts at $0.02/message

Available 24/7

Transform Banking Operations with AI

14-day free trial. No credit card required

Testimonials

Businesses with successful customer service start

with Wonderchat

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

Industry Grade Compliance

Wonderchat is GDPR compliant and AICPA SOC 2 Certified.

FAQ

What is agentic AI in banking?

Agentic AI in banking refers to autonomous AI systems that can make decisions and take actions on behalf of financial institutions. Unlike basic chatbots, these AI agents can understand complex banking policies, automate workflows, and provide verifiable answers from your knowledge base. Wonderchat's agentic AI platform enables banks to automate customer service and internal operations while maintaining regulatory compliance through source attribution and verification systems that eliminate AI hallucinations.

How does agentic AI ensure banking compliance?

Wonderchat's agentic AI ensures compliance in banking through several key mechanisms: 1. Source attribution: Every response includes references to the original banking documentation, creating a clear audit trail. 2. Enterprise-grade security: SOC 2 and GDPR compliance built into the platform ensures data handling meets regulatory requirements. 3. Continuous verification: The system flags potential inaccuracies and requires validation for uncertain responses, preventing AI hallucinations. 4. Knowledge base control: Banking institutions maintain complete control over the information used to train the AI, ensuring only approved content informs responses.

Can agentic AI integrate with existing banking systems?

Yes, Wonderchat's agentic AI platform is designed to integrate seamlessly with existing banking infrastructure. The platform features: - Native integrations with CRMs, helpdesks, and communication tools - REST API for programmatic access and custom integrations - Zapier connection for thousands of additional application integrations - Flexible deployment options via API/SDK for custom implementations This allows banks to connect AI agents to their existing knowledge bases, customer service platforms, and internal systems with minimal disruption.

What banking operations can agentic AI automate?

Wonderchat's agentic AI can automate numerous banking operations, including: 1. Customer service: Instantly answer account queries, product information requests, and application status checks 24/7 2. Internal knowledge access: Help employees quickly find accurate information about policies and procedures 3. Guided processes: Walk customers through loan applications, account openings, and other complex workflows 4. Lead qualification: Gather initial information and qualify prospects for banking products and services These automations help banks reduce operational costs while improving service quality and consistency.

Is agentic AI suitable for smaller banking institutions?

Yes, Wonderchat's agentic AI platform is designed to be accessible for financial institutions of all sizes. The no-code platform allows smaller banks to implement sophisticated AI solutions without extensive technical resources. Smaller banks can particularly benefit from agentic AI by: 1. Leveling the playing field with larger competitors through 24/7 automated customer service 2. Reducing operational costs through automation of repetitive queries 3. Ensuring consistent compliance with banking regulations through verifiable AI responses 4. Deploying gradually, starting with specific use cases and expanding over time

How long does it take to implement agentic AI in banking?

With Wonderchat's no-code platform, banks can create and deploy functional AI agents in as little as 5 minutes for basic implementations. More comprehensive banking solutions typically require: 1. Knowledge base preparation: Organizing banking documentation and policies (1-2 weeks) 2. AI training and testing: Building and refining the AI agent (1-2 weeks) 3. Integration with existing systems: Connecting to CRMs, helpdesks, etc. (1-4 weeks depending on complexity) The modular nature of the platform allows banks to start with simple use cases and expand over time, seeing immediate value while building toward more comprehensive implementation.

FAQ

What is agentic AI in banking?

Agentic AI in banking refers to autonomous AI systems that can make decisions and take actions on behalf of financial institutions. Unlike basic chatbots, these AI agents can understand complex banking policies, automate workflows, and provide verifiable answers from your knowledge base. Wonderchat's agentic AI platform enables banks to automate customer service and internal operations while maintaining regulatory compliance through source attribution and verification systems that eliminate AI hallucinations.

How does agentic AI ensure banking compliance?

Wonderchat's agentic AI ensures compliance in banking through several key mechanisms: 1. Source attribution: Every response includes references to the original banking documentation, creating a clear audit trail. 2. Enterprise-grade security: SOC 2 and GDPR compliance built into the platform ensures data handling meets regulatory requirements. 3. Continuous verification: The system flags potential inaccuracies and requires validation for uncertain responses, preventing AI hallucinations. 4. Knowledge base control: Banking institutions maintain complete control over the information used to train the AI, ensuring only approved content informs responses.

Can agentic AI integrate with existing banking systems?

Yes, Wonderchat's agentic AI platform is designed to integrate seamlessly with existing banking infrastructure. The platform features: - Native integrations with CRMs, helpdesks, and communication tools - REST API for programmatic access and custom integrations - Zapier connection for thousands of additional application integrations - Flexible deployment options via API/SDK for custom implementations This allows banks to connect AI agents to their existing knowledge bases, customer service platforms, and internal systems with minimal disruption.

What banking operations can agentic AI automate?

Wonderchat's agentic AI can automate numerous banking operations, including: 1. Customer service: Instantly answer account queries, product information requests, and application status checks 24/7 2. Internal knowledge access: Help employees quickly find accurate information about policies and procedures 3. Guided processes: Walk customers through loan applications, account openings, and other complex workflows 4. Lead qualification: Gather initial information and qualify prospects for banking products and services These automations help banks reduce operational costs while improving service quality and consistency.

Is agentic AI suitable for smaller banking institutions?

Yes, Wonderchat's agentic AI platform is designed to be accessible for financial institutions of all sizes. The no-code platform allows smaller banks to implement sophisticated AI solutions without extensive technical resources. Smaller banks can particularly benefit from agentic AI by: 1. Leveling the playing field with larger competitors through 24/7 automated customer service 2. Reducing operational costs through automation of repetitive queries 3. Ensuring consistent compliance with banking regulations through verifiable AI responses 4. Deploying gradually, starting with specific use cases and expanding over time

How long does it take to implement agentic AI in banking?

With Wonderchat's no-code platform, banks can create and deploy functional AI agents in as little as 5 minutes for basic implementations. More comprehensive banking solutions typically require: 1. Knowledge base preparation: Organizing banking documentation and policies (1-2 weeks) 2. AI training and testing: Building and refining the AI agent (1-2 weeks) 3. Integration with existing systems: Connecting to CRMs, helpdesks, etc. (1-4 weeks depending on complexity) The modular nature of the platform allows banks to start with simple use cases and expand over time, seeing immediate value while building toward more comprehensive implementation.

FAQ

What is agentic AI in banking?

Agentic AI in banking refers to autonomous AI systems that can make decisions and take actions on behalf of financial institutions. Unlike basic chatbots, these AI agents can understand complex banking policies, automate workflows, and provide verifiable answers from your knowledge base. Wonderchat's agentic AI platform enables banks to automate customer service and internal operations while maintaining regulatory compliance through source attribution and verification systems that eliminate AI hallucinations.

How does agentic AI ensure banking compliance?

Wonderchat's agentic AI ensures compliance in banking through several key mechanisms: 1. Source attribution: Every response includes references to the original banking documentation, creating a clear audit trail. 2. Enterprise-grade security: SOC 2 and GDPR compliance built into the platform ensures data handling meets regulatory requirements. 3. Continuous verification: The system flags potential inaccuracies and requires validation for uncertain responses, preventing AI hallucinations. 4. Knowledge base control: Banking institutions maintain complete control over the information used to train the AI, ensuring only approved content informs responses.

Can agentic AI integrate with existing banking systems?

Yes, Wonderchat's agentic AI platform is designed to integrate seamlessly with existing banking infrastructure. The platform features: - Native integrations with CRMs, helpdesks, and communication tools - REST API for programmatic access and custom integrations - Zapier connection for thousands of additional application integrations - Flexible deployment options via API/SDK for custom implementations This allows banks to connect AI agents to their existing knowledge bases, customer service platforms, and internal systems with minimal disruption.

What banking operations can agentic AI automate?

Wonderchat's agentic AI can automate numerous banking operations, including: 1. Customer service: Instantly answer account queries, product information requests, and application status checks 24/7 2. Internal knowledge access: Help employees quickly find accurate information about policies and procedures 3. Guided processes: Walk customers through loan applications, account openings, and other complex workflows 4. Lead qualification: Gather initial information and qualify prospects for banking products and services These automations help banks reduce operational costs while improving service quality and consistency.

Is agentic AI suitable for smaller banking institutions?

Yes, Wonderchat's agentic AI platform is designed to be accessible for financial institutions of all sizes. The no-code platform allows smaller banks to implement sophisticated AI solutions without extensive technical resources. Smaller banks can particularly benefit from agentic AI by: 1. Leveling the playing field with larger competitors through 24/7 automated customer service 2. Reducing operational costs through automation of repetitive queries 3. Ensuring consistent compliance with banking regulations through verifiable AI responses 4. Deploying gradually, starting with specific use cases and expanding over time

How long does it take to implement agentic AI in banking?

With Wonderchat's no-code platform, banks can create and deploy functional AI agents in as little as 5 minutes for basic implementations. More comprehensive banking solutions typically require: 1. Knowledge base preparation: Organizing banking documentation and policies (1-2 weeks) 2. AI training and testing: Building and refining the AI agent (1-2 weeks) 3. Integration with existing systems: Connecting to CRMs, helpdesks, etc. (1-4 weeks depending on complexity) The modular nature of the platform allows banks to start with simple use cases and expand over time, seeing immediate value while building toward more comprehensive implementation.

40+ Languages

Starts at $0.02/message

Available 24/7

Transform Banking Operations with AI

14-day free trial. No credit card required

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited