AI Agents for Banks: Secure Compliance Automation

Transform complex banking operations with Wonderchat's AI agents for KYC and AML compliance. Deploy verifiable, SOC 2 compliant assistants that deliver accurate, source-attributed answers across your financial institution.

Trusted by businesses worldwide

Why Banks Trust Wonderchat's AI Agents

Banking institutions face mounting pressure to maintain regulatory compliance while improving operational efficiency. Manual KYC and AML processes are time-consuming, error-prone, and costly. Wonderchat's AI agents provide a secure solution specifically designed for banking needs. Our platform creates a verifiable knowledge foundation from your banking policies and procedures, ensuring accurate information retrieval with source attribution that eliminates AI hallucination. With enterprise-grade security including SOC 2 and GDPR compliance, Wonderchat seamlessly integrates with your existing systems while providing powerful analytics to continuously improve performance.

Emily

AI Agent

Wonderbot

Welcome to Wonderchat! How can I help you today?

hey i’d like to upgrade to enterprise please

Wonderbot

Sure, please hold on for a second.

Retrieving account details...

Retrieving account details...

Please confirm that you would like to upgrade to Wonderchat Enterprise. Your Visa card ending in 1234 will be charged $480.00 a year.

Cancel

Upgrade

Message...

Easy 5 minute set-up

How Wonderchat Works

Banking-Ready Security Standards

Enterprise-Grade Compliance for Banking

Meet stringent banking regulations with Wonderchat's SOC 2 and GDPR compliant platform. Our enterprise-grade security ensures your sensitive banking data and customer information remains protected throughout AI operations.

SOC 2 certified security

GDPR compliance built-in

Banking-grade data protection

Banking-Ready Security Standards

Enterprise-Grade Compliance for Banking

Meet stringent banking regulations with Wonderchat's SOC 2 and GDPR compliant platform. Our enterprise-grade security ensures your sensitive banking data and customer information remains protected throughout AI operations.

SOC 2 certified security

GDPR compliance built-in

Banking-grade data protection

Banking-Ready Security Standards

Enterprise-Grade Compliance for Banking

Meet stringent banking regulations with Wonderchat's SOC 2 and GDPR compliant platform. Our enterprise-grade security ensures your sensitive banking data and customer information remains protected throughout AI operations.

SOC 2 certified security

GDPR compliance built-in

Banking-grade data protection

Policy-Driven Intelligence

Train AI on Banking Regulations

Build AI agents with deep knowledge of your specific banking policies, KYC processes, and AML guidelines. Quickly import content from websites, regulatory documents, and internal knowledge bases for accurate compliance support.

KYC/AML documentation training

Policy document integration

Regulatory update tracking

Policy-Driven Intelligence

Train AI on Banking Regulations

Build AI agents with deep knowledge of your specific banking policies, KYC processes, and AML guidelines. Quickly import content from websites, regulatory documents, and internal knowledge bases for accurate compliance support.

KYC/AML documentation training

Policy document integration

Regulatory update tracking

Policy-Driven Intelligence

Train AI on Banking Regulations

Build AI agents with deep knowledge of your specific banking policies, KYC processes, and AML guidelines. Quickly import content from websites, regulatory documents, and internal knowledge bases for accurate compliance support.

KYC/AML documentation training

Policy document integration

Regulatory update tracking

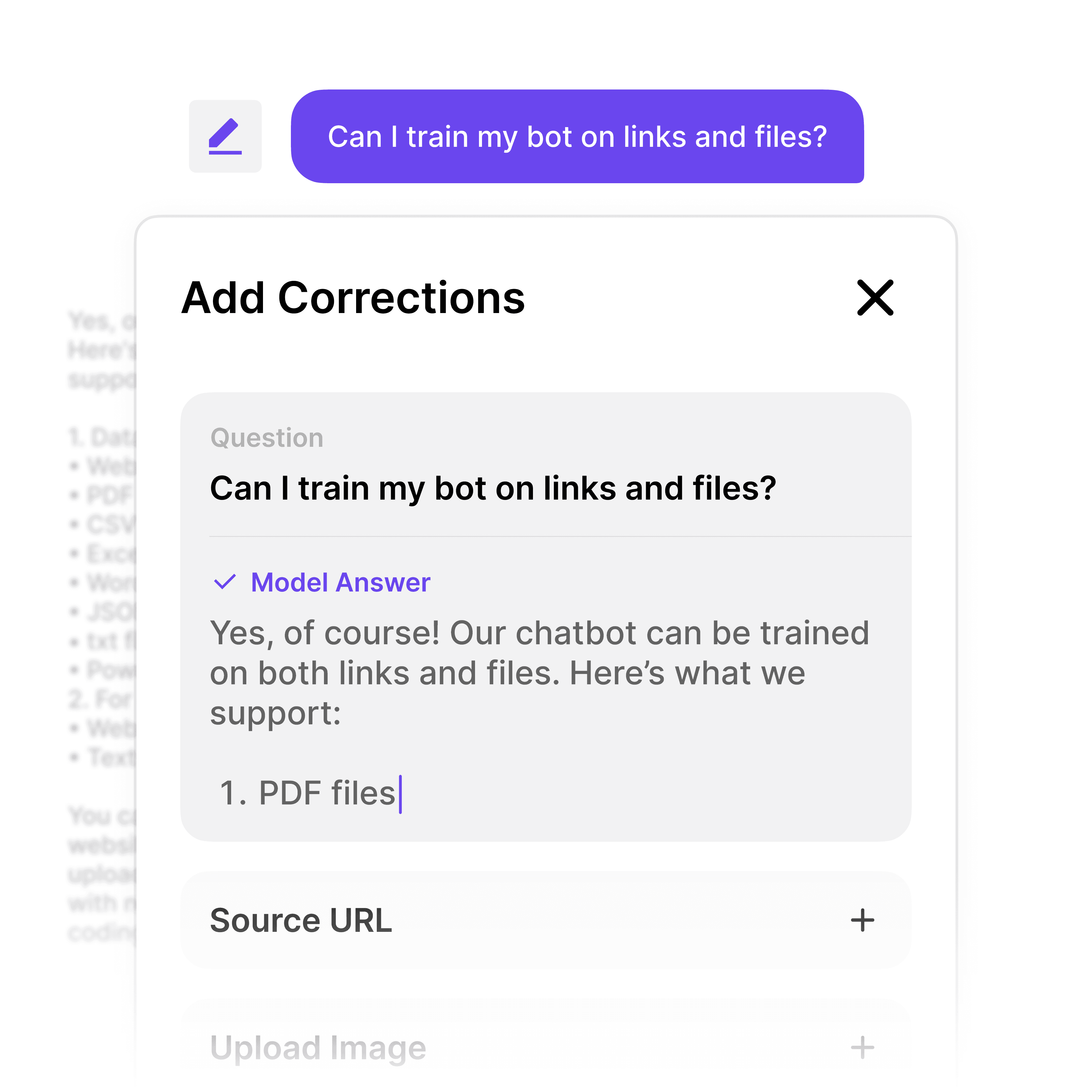

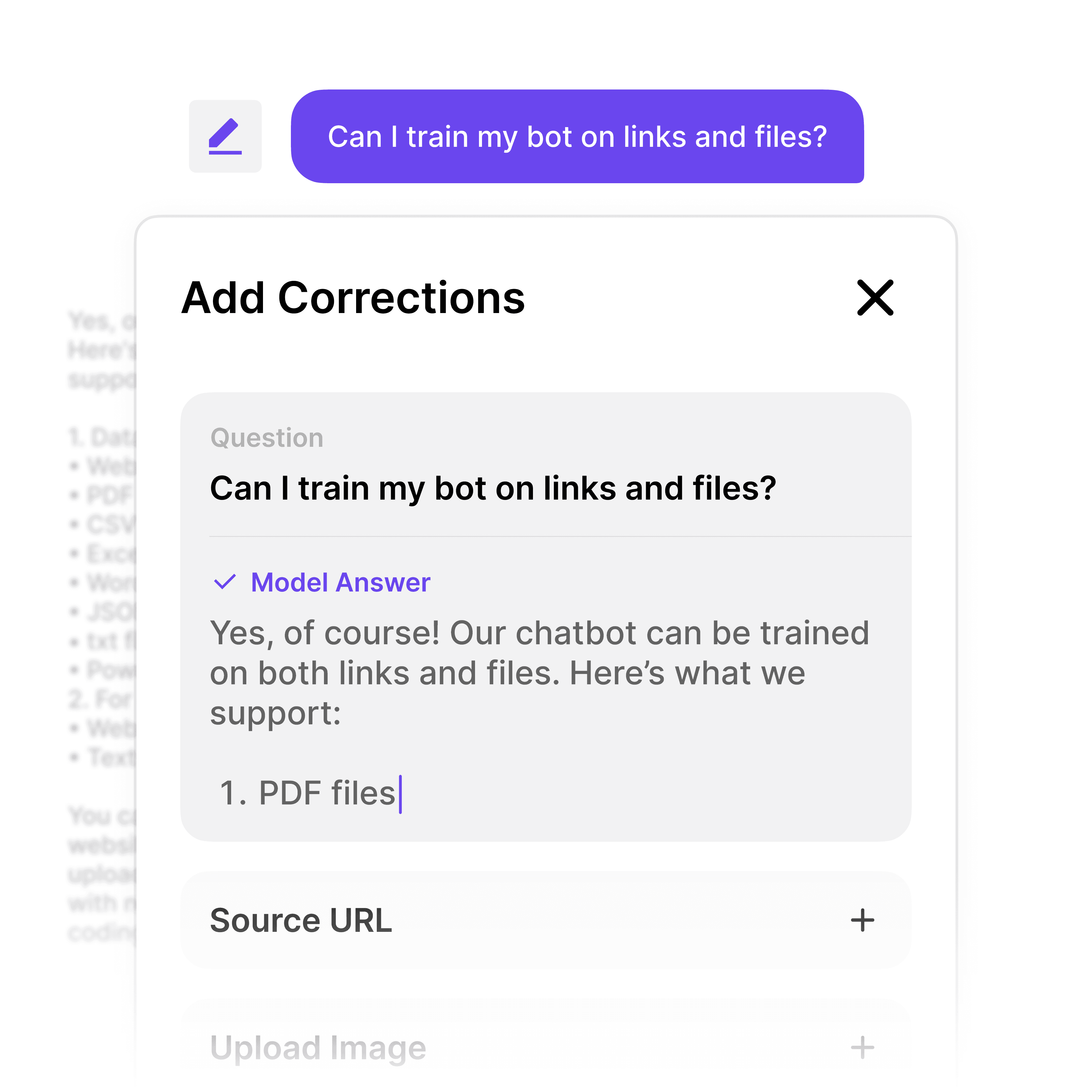

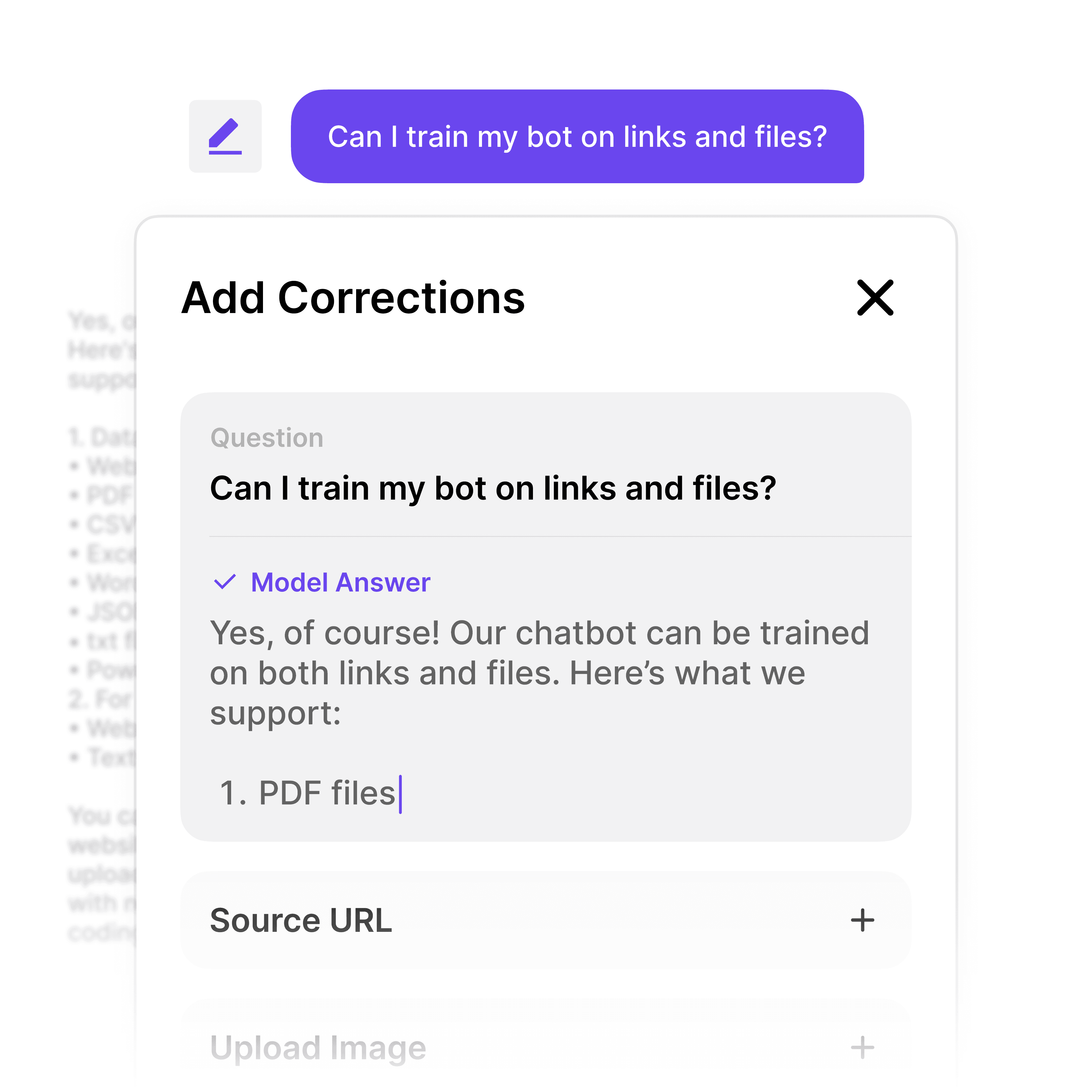

Eliminate AI Hallucinations

Verifiable Banking Information

Ensure accuracy in high-stakes banking operations with Wonderchat's hallucination correction. All AI responses include source attribution to original banking documents, maintaining compliance and reducing regulatory risk.

Source-attributed answers

Verification capabilities

Continuous accuracy improvement

Eliminate AI Hallucinations

Verifiable Banking Information

Ensure accuracy in high-stakes banking operations with Wonderchat's hallucination correction. All AI responses include source attribution to original banking documents, maintaining compliance and reducing regulatory risk.

Source-attributed answers

Verification capabilities

Continuous accuracy improvement

Eliminate AI Hallucinations

Verifiable Banking Information

Ensure accuracy in high-stakes banking operations with Wonderchat's hallucination correction. All AI responses include source attribution to original banking documents, maintaining compliance and reducing regulatory risk.

Source-attributed answers

Verification capabilities

Continuous accuracy improvement

5-minute set up with our native integration

Set Up Banking AI Agents in Minutes

1

Create your AI chatbot – Pick the perfect AI model fit for your support needs.

2

Train AI with Docs, FAQs & Policies – Upload knowledge base files and site links.

3

Customise Workflows & Escalation Rules – AI handles what it can, and escalates what it can’t.

4

Monitor & Optimise with Analytics – See where customers get stuck and fine-tune responses.

Compliance Performance Insights

Banking Analytics Dashboard

Monitor your AI agents' performance with comprehensive analytics. Track compliance query resolution rates, identify knowledge gaps in banking procedures, and gain actionable insights to optimize regulatory operations.

Compliance query tracking

Knowledge gap identification

Regulatory performance metrics

Compliance Performance Insights

Banking Analytics Dashboard

Monitor your AI agents' performance with comprehensive analytics. Track compliance query resolution rates, identify knowledge gaps in banking procedures, and gain actionable insights to optimize regulatory operations.

Compliance query tracking

Knowledge gap identification

Regulatory performance metrics

Compliance Performance Insights

Banking Analytics Dashboard

Monitor your AI agents' performance with comprehensive analytics. Track compliance query resolution rates, identify knowledge gaps in banking procedures, and gain actionable insights to optimize regulatory operations.

Compliance query tracking

Knowledge gap identification

Regulatory performance metrics

Streamlined Banking Processes

Automate Complex Banking Workflows

Build structured conversational flows for complex banking processes like customer onboarding, KYC verification, and compliance checks. Guide customers and employees through multi-step procedures with consistent accuracy.

KYC process automation

Compliance check workflows

Customer onboarding sequences

Streamlined Banking Processes

Automate Complex Banking Workflows

Build structured conversational flows for complex banking processes like customer onboarding, KYC verification, and compliance checks. Guide customers and employees through multi-step procedures with consistent accuracy.

KYC process automation

Compliance check workflows

Customer onboarding sequences

Streamlined Banking Processes

Automate Complex Banking Workflows

Build structured conversational flows for complex banking processes like customer onboarding, KYC verification, and compliance checks. Guide customers and employees through multi-step procedures with consistent accuracy.

KYC process automation

Compliance check workflows

Customer onboarding sequences

40+ Languages

Starts at $0.02/message

Available 24/7

Deploy Secure AI Agents for Your Bank

14-day free trial. No credit card required

Testimonials

Businesses with successful customer service start

with Wonderchat

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

Industry Grade Compliance

Wonderchat is GDPR compliant and AICPA SOC 2 Certified.

FAQ

How do AI agents improve KYC and AML compliance in banking?

Wonderchat's AI agents streamline KYC and AML processes by providing instant, accurate information about compliance procedures from your banking policies. They automate repetitive compliance checks, ensure consistent application of regulations, and maintain verifiable records of all interactions with source attribution. The platform continuously learns from real-world banking scenarios, improving accuracy while reducing the manual workload on compliance teams. This allows your compliance officers to focus on complex cases while routine matters are handled efficiently by AI agents.

Is Wonderchat secure enough for sensitive banking data?

Yes, Wonderchat is built specifically with enterprise-grade security for regulated industries like banking. Our platform is SOC 2 certified and GDPR compliant, ensuring that sensitive banking and customer information remains protected. We offer flexible deployment options, robust role-based access controls, and comprehensive data encryption. All AI responses are verifiable with source attribution, providing an audit trail for compliance purposes. Wonderchat's security infrastructure is designed to meet the stringent requirements of financial institutions.

How does Wonderchat integrate with existing banking systems?

Wonderchat seamlessly integrates with your bank's existing technology stack through our comprehensive API and SDK offerings. We support direct connections to CRMs, helpdesks, and banking-specific software systems. The platform can be deployed across multiple channels including your banking website, internal intranet, and customer-facing applications. For enterprise banking clients, we offer custom integration services to ensure the AI agents work harmoniously with proprietary banking systems and databases while maintaining security protocols.

What ROI can banks expect from implementing Wonderchat's AI agents?

Banks implementing Wonderchat's AI agents typically see significant ROI through several key metrics: reduction in compliance-related operational costs, faster processing of KYC/AML procedures, decreased error rates in regulatory processes, and improved customer satisfaction through quicker response times. The platform can deflect up to 70% of common compliance and policy-related queries, freeing compliance officers to focus on complex cases. Additionally, the verifiable nature of AI responses reduces regulatory risk and potential compliance-related penalties.

How quickly can we deploy AI agents across our banking operations?

Wonderchat's no-code platform enables rapid deployment of AI agents across your banking operations. Basic implementation with training on existing documentation can be completed in under 5 minutes. For enterprise banking deployments with complex integrations and custom workflows, our dedicated implementation team works closely with your IT and compliance departments to ensure proper configuration, typically completing full enterprise deployment within weeks rather than months. The platform's intuitive interface allows for ongoing adjustments and improvements without requiring technical expertise.

Can Wonderchat handle multi-language support for international banking?

Yes, Wonderchat supports over 40 languages, making it ideal for international banking operations. The AI agents automatically detect and respond in the user's preferred language, ensuring consistent customer experiences across global markets. This multilingual capability is particularly valuable for banks with international presence, enabling standardized compliance processes while accommodating local language requirements. The system maintains the same level of accuracy and source attribution regardless of the language being used.

FAQ

How do AI agents improve KYC and AML compliance in banking?

Wonderchat's AI agents streamline KYC and AML processes by providing instant, accurate information about compliance procedures from your banking policies. They automate repetitive compliance checks, ensure consistent application of regulations, and maintain verifiable records of all interactions with source attribution. The platform continuously learns from real-world banking scenarios, improving accuracy while reducing the manual workload on compliance teams. This allows your compliance officers to focus on complex cases while routine matters are handled efficiently by AI agents.

Is Wonderchat secure enough for sensitive banking data?

Yes, Wonderchat is built specifically with enterprise-grade security for regulated industries like banking. Our platform is SOC 2 certified and GDPR compliant, ensuring that sensitive banking and customer information remains protected. We offer flexible deployment options, robust role-based access controls, and comprehensive data encryption. All AI responses are verifiable with source attribution, providing an audit trail for compliance purposes. Wonderchat's security infrastructure is designed to meet the stringent requirements of financial institutions.

How does Wonderchat integrate with existing banking systems?

Wonderchat seamlessly integrates with your bank's existing technology stack through our comprehensive API and SDK offerings. We support direct connections to CRMs, helpdesks, and banking-specific software systems. The platform can be deployed across multiple channels including your banking website, internal intranet, and customer-facing applications. For enterprise banking clients, we offer custom integration services to ensure the AI agents work harmoniously with proprietary banking systems and databases while maintaining security protocols.

What ROI can banks expect from implementing Wonderchat's AI agents?

Banks implementing Wonderchat's AI agents typically see significant ROI through several key metrics: reduction in compliance-related operational costs, faster processing of KYC/AML procedures, decreased error rates in regulatory processes, and improved customer satisfaction through quicker response times. The platform can deflect up to 70% of common compliance and policy-related queries, freeing compliance officers to focus on complex cases. Additionally, the verifiable nature of AI responses reduces regulatory risk and potential compliance-related penalties.

How quickly can we deploy AI agents across our banking operations?

Wonderchat's no-code platform enables rapid deployment of AI agents across your banking operations. Basic implementation with training on existing documentation can be completed in under 5 minutes. For enterprise banking deployments with complex integrations and custom workflows, our dedicated implementation team works closely with your IT and compliance departments to ensure proper configuration, typically completing full enterprise deployment within weeks rather than months. The platform's intuitive interface allows for ongoing adjustments and improvements without requiring technical expertise.

Can Wonderchat handle multi-language support for international banking?

Yes, Wonderchat supports over 40 languages, making it ideal for international banking operations. The AI agents automatically detect and respond in the user's preferred language, ensuring consistent customer experiences across global markets. This multilingual capability is particularly valuable for banks with international presence, enabling standardized compliance processes while accommodating local language requirements. The system maintains the same level of accuracy and source attribution regardless of the language being used.

FAQ

How do AI agents improve KYC and AML compliance in banking?

Wonderchat's AI agents streamline KYC and AML processes by providing instant, accurate information about compliance procedures from your banking policies. They automate repetitive compliance checks, ensure consistent application of regulations, and maintain verifiable records of all interactions with source attribution. The platform continuously learns from real-world banking scenarios, improving accuracy while reducing the manual workload on compliance teams. This allows your compliance officers to focus on complex cases while routine matters are handled efficiently by AI agents.

Is Wonderchat secure enough for sensitive banking data?

Yes, Wonderchat is built specifically with enterprise-grade security for regulated industries like banking. Our platform is SOC 2 certified and GDPR compliant, ensuring that sensitive banking and customer information remains protected. We offer flexible deployment options, robust role-based access controls, and comprehensive data encryption. All AI responses are verifiable with source attribution, providing an audit trail for compliance purposes. Wonderchat's security infrastructure is designed to meet the stringent requirements of financial institutions.

How does Wonderchat integrate with existing banking systems?

Wonderchat seamlessly integrates with your bank's existing technology stack through our comprehensive API and SDK offerings. We support direct connections to CRMs, helpdesks, and banking-specific software systems. The platform can be deployed across multiple channels including your banking website, internal intranet, and customer-facing applications. For enterprise banking clients, we offer custom integration services to ensure the AI agents work harmoniously with proprietary banking systems and databases while maintaining security protocols.

What ROI can banks expect from implementing Wonderchat's AI agents?

Banks implementing Wonderchat's AI agents typically see significant ROI through several key metrics: reduction in compliance-related operational costs, faster processing of KYC/AML procedures, decreased error rates in regulatory processes, and improved customer satisfaction through quicker response times. The platform can deflect up to 70% of common compliance and policy-related queries, freeing compliance officers to focus on complex cases. Additionally, the verifiable nature of AI responses reduces regulatory risk and potential compliance-related penalties.

How quickly can we deploy AI agents across our banking operations?

Wonderchat's no-code platform enables rapid deployment of AI agents across your banking operations. Basic implementation with training on existing documentation can be completed in under 5 minutes. For enterprise banking deployments with complex integrations and custom workflows, our dedicated implementation team works closely with your IT and compliance departments to ensure proper configuration, typically completing full enterprise deployment within weeks rather than months. The platform's intuitive interface allows for ongoing adjustments and improvements without requiring technical expertise.

Can Wonderchat handle multi-language support for international banking?

Yes, Wonderchat supports over 40 languages, making it ideal for international banking operations. The AI agents automatically detect and respond in the user's preferred language, ensuring consistent customer experiences across global markets. This multilingual capability is particularly valuable for banks with international presence, enabling standardized compliance processes while accommodating local language requirements. The system maintains the same level of accuracy and source attribution regardless of the language being used.

40+ Languages

Starts at $0.02/message

Available 24/7

Deploy Secure AI Agents for Your Bank

14-day free trial. No credit card required

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited