Chat with Financial Product AI for Instant Answers

Empower employees and customers to chat with financial product options using AI trained on your specific documentation. Reduce support workload while providing accurate, verifiable answers 24/7.

Trusted by businesses worldwide

Why Financial Products Need Smart AI Chat

Financial products are complex, with intricate details that overwhelm both customers and employees. Traditional FAQs and knowledge bases fall short, leading to support bottlenecks and frustrated users. Wonderchat transforms your financial product documentation into an intelligent AI chatbot that delivers precise, source-attributed answers. Our platform ensures regulatory compliance while providing instant clarification on 401(k)s, HSAs, insurance options, and investment accounts—exactly when users need it.

Emily

AI Agent

Wonderbot

Welcome to Wonderchat! How can I help you today?

hey i’d like to upgrade to enterprise please

Wonderbot

Sure, please hold on for a second.

Retrieving account details...

Retrieving account details...

Please confirm that you would like to upgrade to Wonderchat Enterprise. Your Visa card ending in 1234 will be charged $480.00 a year.

Cancel

Upgrade

Message...

Easy 5 minute set-up

How Wonderchat Works

Import Financial Documentation Easily

Train AI on Your Financial Product Data

Quickly build an AI chatbot by uploading your financial product documentation, benefits guides, and policy documents. Your chatbot learns directly from your materials to provide accurate answers.

PDF and DOCX support

Website content integration

Multiple data sources

Import Financial Documentation Easily

Train AI on Your Financial Product Data

Quickly build an AI chatbot by uploading your financial product documentation, benefits guides, and policy documents. Your chatbot learns directly from your materials to provide accurate answers.

PDF and DOCX support

Website content integration

Multiple data sources

Import Financial Documentation Easily

Train AI on Your Financial Product Data

Quickly build an AI chatbot by uploading your financial product documentation, benefits guides, and policy documents. Your chatbot learns directly from your materials to provide accurate answers.

PDF and DOCX support

Website content integration

Multiple data sources

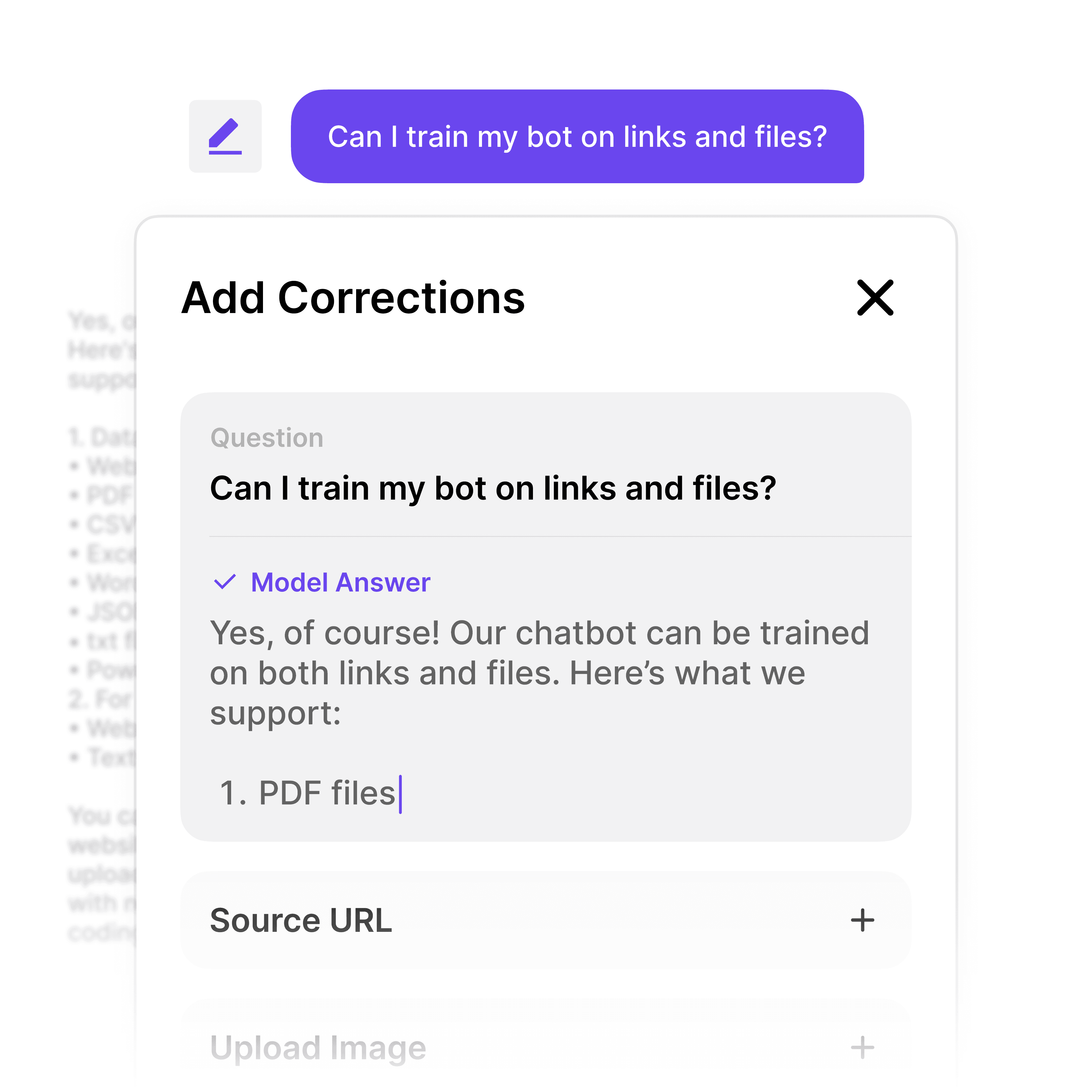

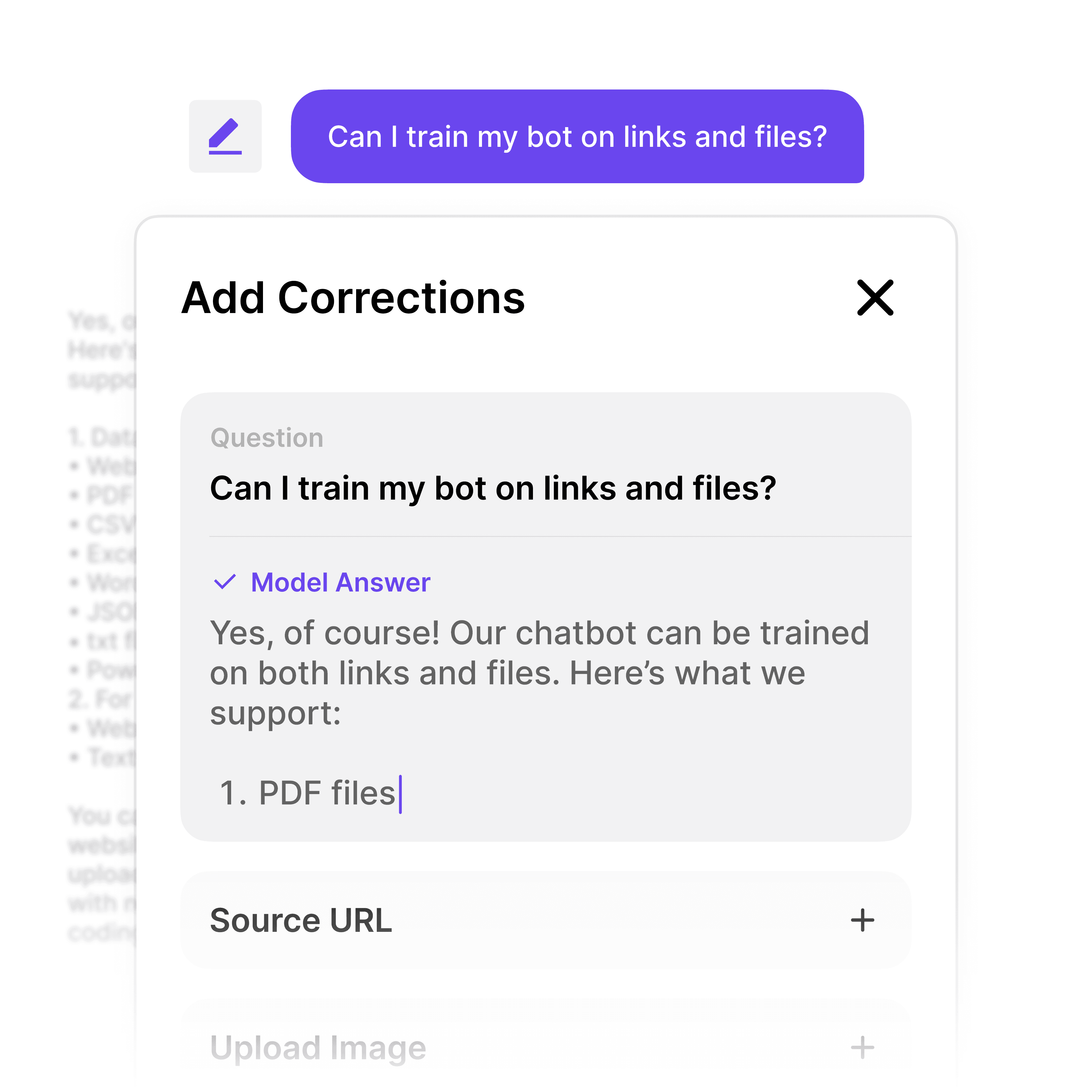

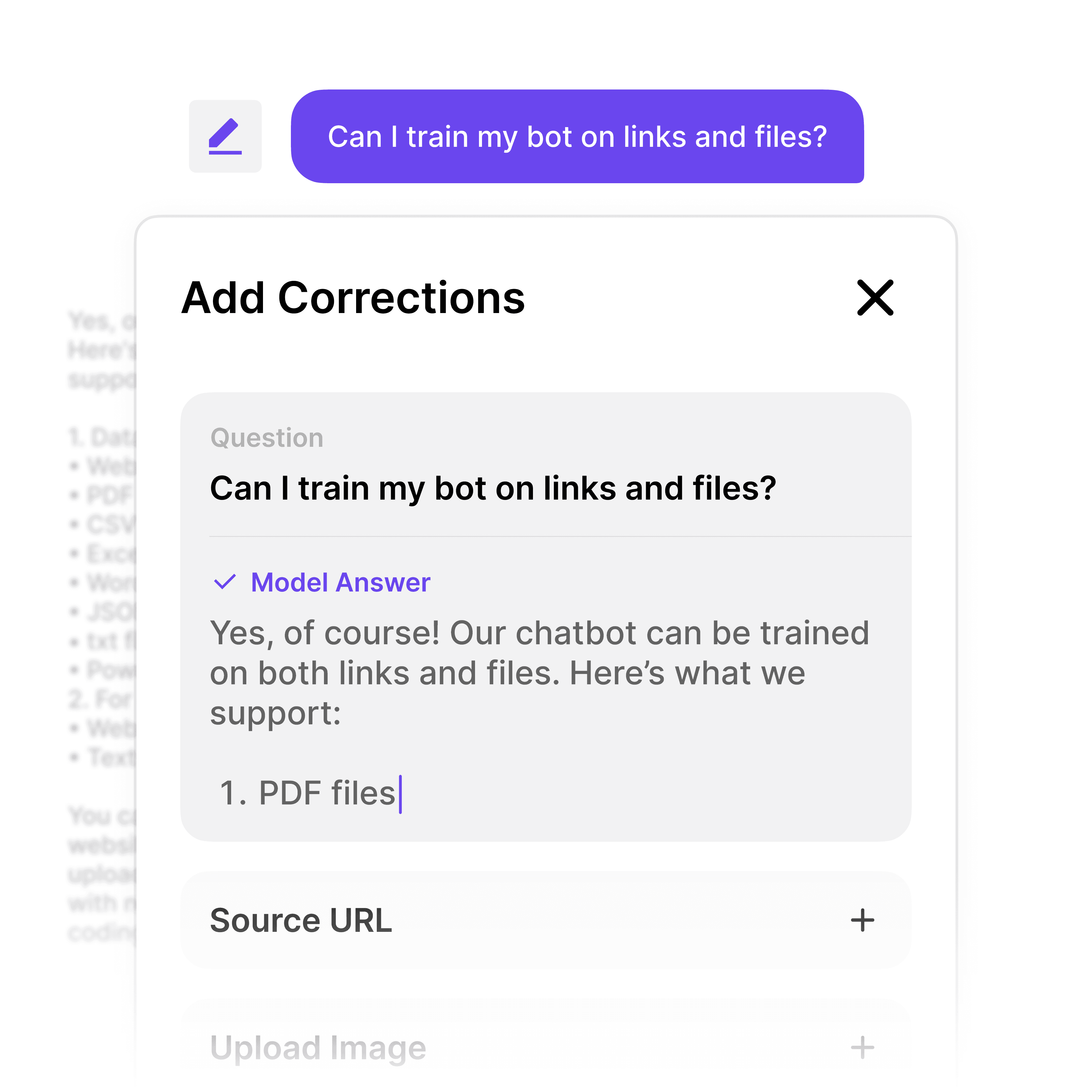

Maintain Financial Accuracy

Eliminate AI Hallucinations with Source Attribution

Ensure your financial product information is always accurate. Every answer is attributed to its source document, and administrators can correct any inaccuracies to continuously improve the AI's knowledge.

Verified source links

Hallucination prevention

Admin correction tools

Maintain Financial Accuracy

Eliminate AI Hallucinations with Source Attribution

Ensure your financial product information is always accurate. Every answer is attributed to its source document, and administrators can correct any inaccuracies to continuously improve the AI's knowledge.

Verified source links

Hallucination prevention

Admin correction tools

Maintain Financial Accuracy

Eliminate AI Hallucinations with Source Attribution

Ensure your financial product information is always accurate. Every answer is attributed to its source document, and administrators can correct any inaccuracies to continuously improve the AI's knowledge.

Verified source links

Hallucination prevention

Admin correction tools

Secure Financial Information

Enterprise-Grade Security for Financial Data

Meet stringent financial industry requirements with SOC 2 and GDPR compliant infrastructure. Your sensitive financial product information remains secure while being accessible to those who need it.

SOC 2 compliance

GDPR adherence

Role-based access

Secure Financial Information

Enterprise-Grade Security for Financial Data

Meet stringent financial industry requirements with SOC 2 and GDPR compliant infrastructure. Your sensitive financial product information remains secure while being accessible to those who need it.

SOC 2 compliance

GDPR adherence

Role-based access

Secure Financial Information

Enterprise-Grade Security for Financial Data

Meet stringent financial industry requirements with SOC 2 and GDPR compliant infrastructure. Your sensitive financial product information remains secure while being accessible to those who need it.

SOC 2 compliance

GDPR adherence

Role-based access

5-minute set up with our native integration

Set Up Your Financial Product Chatbot in Minutes

1

Create your AI chatbot – Pick the perfect AI model fit for your support needs.

2

Train AI with Docs, FAQs & Policies – Upload knowledge base files and site links.

3

Customise Workflows & Escalation Rules – AI handles what it can, and escalates what it can’t.

4

Monitor & Optimise with Analytics – See where customers get stuck and fine-tune responses.

Guide Financial Decision-Making

Create Custom Financial Product Workflows

Design conversational flows that guide employees and customers through complex financial product selection. Help users navigate options based on their specific needs and circumstances.

Personalized recommendations

Step-by-step guidance

Conditional logic paths

Guide Financial Decision-Making

Create Custom Financial Product Workflows

Design conversational flows that guide employees and customers through complex financial product selection. Help users navigate options based on their specific needs and circumstances.

Personalized recommendations

Step-by-step guidance

Conditional logic paths

Guide Financial Decision-Making

Create Custom Financial Product Workflows

Design conversational flows that guide employees and customers through complex financial product selection. Help users navigate options based on their specific needs and circumstances.

Personalized recommendations

Step-by-step guidance

Conditional logic paths

Understand Financial Product Questions

Insight Dashboard for Product Engagement

Gain valuable insights into how employees and customers interact with your financial products. Identify common questions, knowledge gaps, and opportunities to improve your financial product information.

Usage analytics

Question tracking

Knowledge gap identification

Understand Financial Product Questions

Insight Dashboard for Product Engagement

Gain valuable insights into how employees and customers interact with your financial products. Identify common questions, knowledge gaps, and opportunities to improve your financial product information.

Usage analytics

Question tracking

Knowledge gap identification

Understand Financial Product Questions

Insight Dashboard for Product Engagement

Gain valuable insights into how employees and customers interact with your financial products. Identify common questions, knowledge gaps, and opportunities to improve your financial product information.

Usage analytics

Question tracking

Knowledge gap identification

40+ Languages

Starts at $0.02/message

Available 24/7

Chat with Financial Products Instantly

14-day free trial. No credit card required

Testimonials

Businesses with successful customer service start

with Wonderchat

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

Industry Grade Compliance

Wonderchat is GDPR compliant and AICPA SOC 2 Certified.

FAQ

How quickly can I deploy a financial product chatbot?

You can deploy a fully functional AI chatbot trained on your financial product documentation in under 5 minutes. Simply upload your financial product guides, policy documents, and other relevant materials, or connect Wonderchat to your existing knowledge base. The platform automatically processes and indexes your content, making it immediately available for accurate responses about your specific financial products.

Can the chatbot handle complex financial product questions?

Yes, Wonderchat excels at navigating complex financial product information. The AI is trained specifically on your documentation, allowing it to understand intricate details about 401(k)s, HSAs, investment options, insurance plans, and other financial products. For questions requiring human expertise, the platform offers seamless escalation to financial advisors or HR team members while maintaining conversation context.

How does Wonderchat ensure financial information accuracy?

Wonderchat maintains accuracy through source attribution and continuous learning. Every answer about financial products is linked to its specific source document, eliminating AI hallucination. Administrators can review conversations, correct any inaccuracies, and the system learns from these corrections. For financial products where regulatory compliance is critical, this verification system ensures employees and customers always receive trustworthy information.

Can the chatbot integrate with our existing financial systems?

Wonderchat seamlessly integrates with your existing financial technology stack through native integrations and APIs. Connect with CRMs like HubSpot, helpdesks such as Zendesk, and communication tools including Slack. For financial institutions, this means the chatbot can work alongside your current systems while providing a unified experience for both employees seeking product information and customers exploring options.

Is Wonderchat secure enough for sensitive financial information?

Absolutely. Wonderchat is built for enterprise security with SOC 2 and GDPR compliance, making it suitable for financial institutions and organizations handling sensitive financial product data. The platform offers role-based access controls, secure data handling protocols, and flexible deployment options that meet strict financial industry regulations and privacy requirements.

How can we measure the ROI of a financial product chatbot?

Wonderchat provides comprehensive analytics to measure ROI across several dimensions: (1) Support efficiency - track reduction in financial product questions handled by HR or support teams, (2) Employee/customer satisfaction - measure faster access to accurate financial information, (3) Knowledge gaps - identify frequently asked questions about financial products that need better documentation, and (4) Engagement metrics - understand which financial products generate the most questions or interest.

FAQ

How quickly can I deploy a financial product chatbot?

You can deploy a fully functional AI chatbot trained on your financial product documentation in under 5 minutes. Simply upload your financial product guides, policy documents, and other relevant materials, or connect Wonderchat to your existing knowledge base. The platform automatically processes and indexes your content, making it immediately available for accurate responses about your specific financial products.

Can the chatbot handle complex financial product questions?

Yes, Wonderchat excels at navigating complex financial product information. The AI is trained specifically on your documentation, allowing it to understand intricate details about 401(k)s, HSAs, investment options, insurance plans, and other financial products. For questions requiring human expertise, the platform offers seamless escalation to financial advisors or HR team members while maintaining conversation context.

How does Wonderchat ensure financial information accuracy?

Wonderchat maintains accuracy through source attribution and continuous learning. Every answer about financial products is linked to its specific source document, eliminating AI hallucination. Administrators can review conversations, correct any inaccuracies, and the system learns from these corrections. For financial products where regulatory compliance is critical, this verification system ensures employees and customers always receive trustworthy information.

Can the chatbot integrate with our existing financial systems?

Wonderchat seamlessly integrates with your existing financial technology stack through native integrations and APIs. Connect with CRMs like HubSpot, helpdesks such as Zendesk, and communication tools including Slack. For financial institutions, this means the chatbot can work alongside your current systems while providing a unified experience for both employees seeking product information and customers exploring options.

Is Wonderchat secure enough for sensitive financial information?

Absolutely. Wonderchat is built for enterprise security with SOC 2 and GDPR compliance, making it suitable for financial institutions and organizations handling sensitive financial product data. The platform offers role-based access controls, secure data handling protocols, and flexible deployment options that meet strict financial industry regulations and privacy requirements.

How can we measure the ROI of a financial product chatbot?

Wonderchat provides comprehensive analytics to measure ROI across several dimensions: (1) Support efficiency - track reduction in financial product questions handled by HR or support teams, (2) Employee/customer satisfaction - measure faster access to accurate financial information, (3) Knowledge gaps - identify frequently asked questions about financial products that need better documentation, and (4) Engagement metrics - understand which financial products generate the most questions or interest.

FAQ

How quickly can I deploy a financial product chatbot?

You can deploy a fully functional AI chatbot trained on your financial product documentation in under 5 minutes. Simply upload your financial product guides, policy documents, and other relevant materials, or connect Wonderchat to your existing knowledge base. The platform automatically processes and indexes your content, making it immediately available for accurate responses about your specific financial products.

Can the chatbot handle complex financial product questions?

Yes, Wonderchat excels at navigating complex financial product information. The AI is trained specifically on your documentation, allowing it to understand intricate details about 401(k)s, HSAs, investment options, insurance plans, and other financial products. For questions requiring human expertise, the platform offers seamless escalation to financial advisors or HR team members while maintaining conversation context.

How does Wonderchat ensure financial information accuracy?

Wonderchat maintains accuracy through source attribution and continuous learning. Every answer about financial products is linked to its specific source document, eliminating AI hallucination. Administrators can review conversations, correct any inaccuracies, and the system learns from these corrections. For financial products where regulatory compliance is critical, this verification system ensures employees and customers always receive trustworthy information.

Can the chatbot integrate with our existing financial systems?

Wonderchat seamlessly integrates with your existing financial technology stack through native integrations and APIs. Connect with CRMs like HubSpot, helpdesks such as Zendesk, and communication tools including Slack. For financial institutions, this means the chatbot can work alongside your current systems while providing a unified experience for both employees seeking product information and customers exploring options.

Is Wonderchat secure enough for sensitive financial information?

Absolutely. Wonderchat is built for enterprise security with SOC 2 and GDPR compliance, making it suitable for financial institutions and organizations handling sensitive financial product data. The platform offers role-based access controls, secure data handling protocols, and flexible deployment options that meet strict financial industry regulations and privacy requirements.

How can we measure the ROI of a financial product chatbot?

Wonderchat provides comprehensive analytics to measure ROI across several dimensions: (1) Support efficiency - track reduction in financial product questions handled by HR or support teams, (2) Employee/customer satisfaction - measure faster access to accurate financial information, (3) Knowledge gaps - identify frequently asked questions about financial products that need better documentation, and (4) Engagement metrics - understand which financial products generate the most questions or interest.

40+ Languages

Starts at $0.02/message

Available 24/7

Chat with Financial Products Instantly

14-day free trial. No credit card required

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited