Compliant Chatbot for Financial Institutions

Generic AI poses significant compliance risks in finance. Wonderchat builds secure chatbots trained exclusively on your policies, delivering verifiable answers with source attribution to ensure regulatory compliance.

Trusted by businesses worldwide

Why Financial Institutions Trust Wonderchat

Financial institutions face unique challenges: complex policies, strict regulations, and customers needing instant, accurate information. Wonderchat's AI platform bridges this gap by creating chatbots trained specifically on your financial documentation, ensuring every response is compliant, accurate, and source-verified. With SOC 2 and GDPR compliance built-in, our solution helps banking and financial services organizations automate customer inquiries while maintaining the highest standards of data security and regulatory adherence.

Emily

AI Agent

Wonderbot

Welcome to Wonderchat! How can I help you today?

hey i’d like to upgrade to enterprise please

Wonderbot

Sure, please hold on for a second.

Retrieving account details...

Retrieving account details...

Please confirm that you would like to upgrade to Wonderchat Enterprise. Your Visa card ending in 1234 will be charged $480.00 a year.

Cancel

Upgrade

Message...

Easy 5 minute set-up

How Wonderchat Works

Regulatory Adherence Built-in

Enterprise-Grade Compliance Security

Protect sensitive financial data with Wonderchat's SOC 2 and GDPR compliant infrastructure. Our platform ensures your AI chatbot meets the strictest security standards required by financial regulators.

SOC 2 certified

GDPR compliant

Data security guaranteed

Regulatory Adherence Built-in

Enterprise-Grade Compliance Security

Protect sensitive financial data with Wonderchat's SOC 2 and GDPR compliant infrastructure. Our platform ensures your AI chatbot meets the strictest security standards required by financial regulators.

SOC 2 certified

GDPR compliant

Data security guaranteed

Regulatory Adherence Built-in

Enterprise-Grade Compliance Security

Protect sensitive financial data with Wonderchat's SOC 2 and GDPR compliant infrastructure. Our platform ensures your AI chatbot meets the strictest security standards required by financial regulators.

SOC 2 certified

GDPR compliant

Data security guaranteed

Financial Knowledge Integration

Train AI on Your Financial Policies

Create an AI chatbot that knows your specific financial products, policies, and procedures. Upload documents, crawl websites, and connect help desks to build a comprehensive knowledge foundation.

Policy document integration

Automatic website crawling

Multiple file formats

Financial Knowledge Integration

Train AI on Your Financial Policies

Create an AI chatbot that knows your specific financial products, policies, and procedures. Upload documents, crawl websites, and connect help desks to build a comprehensive knowledge foundation.

Policy document integration

Automatic website crawling

Multiple file formats

Financial Knowledge Integration

Train AI on Your Financial Policies

Create an AI chatbot that knows your specific financial products, policies, and procedures. Upload documents, crawl websites, and connect help desks to build a comprehensive knowledge foundation.

Policy document integration

Automatic website crawling

Multiple file formats

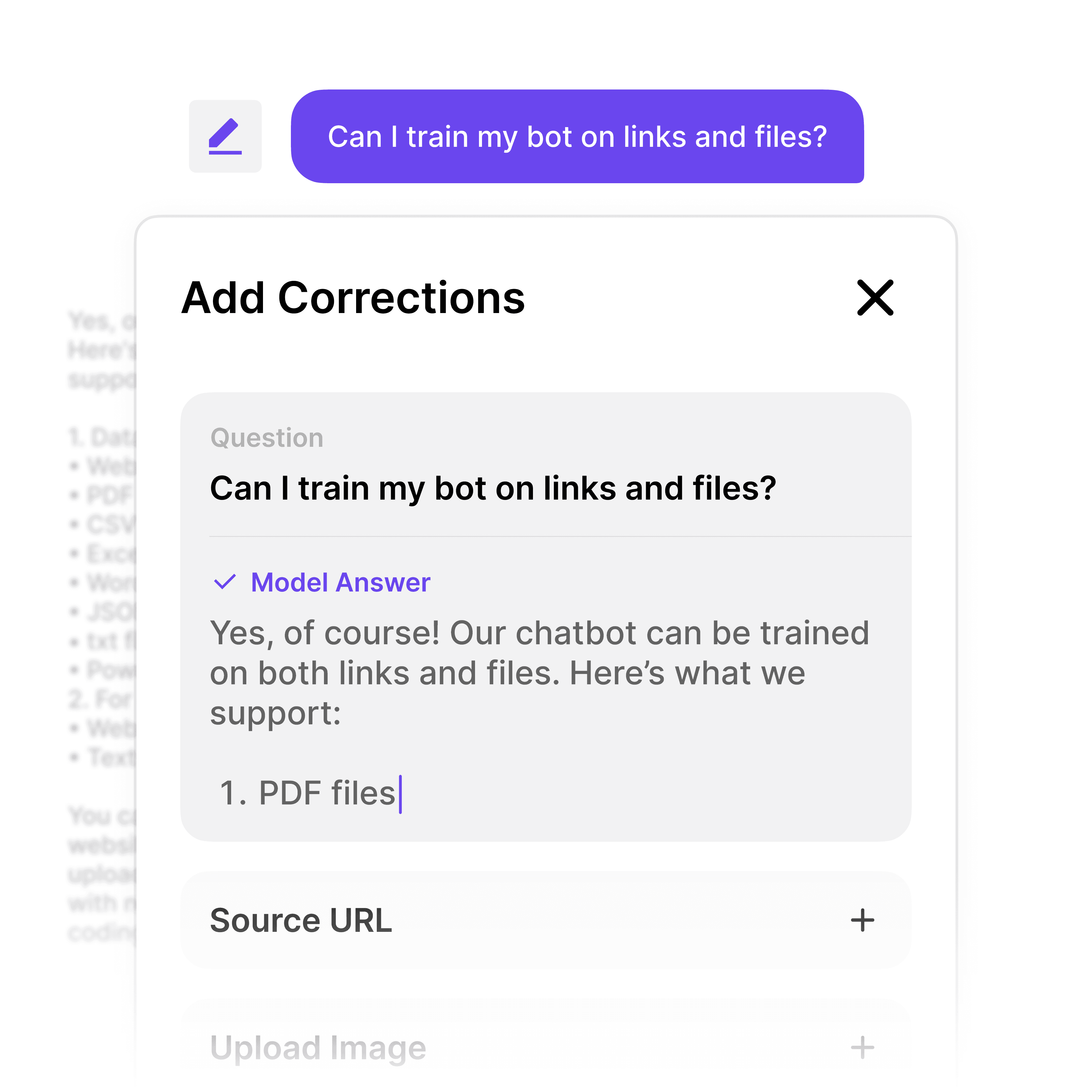

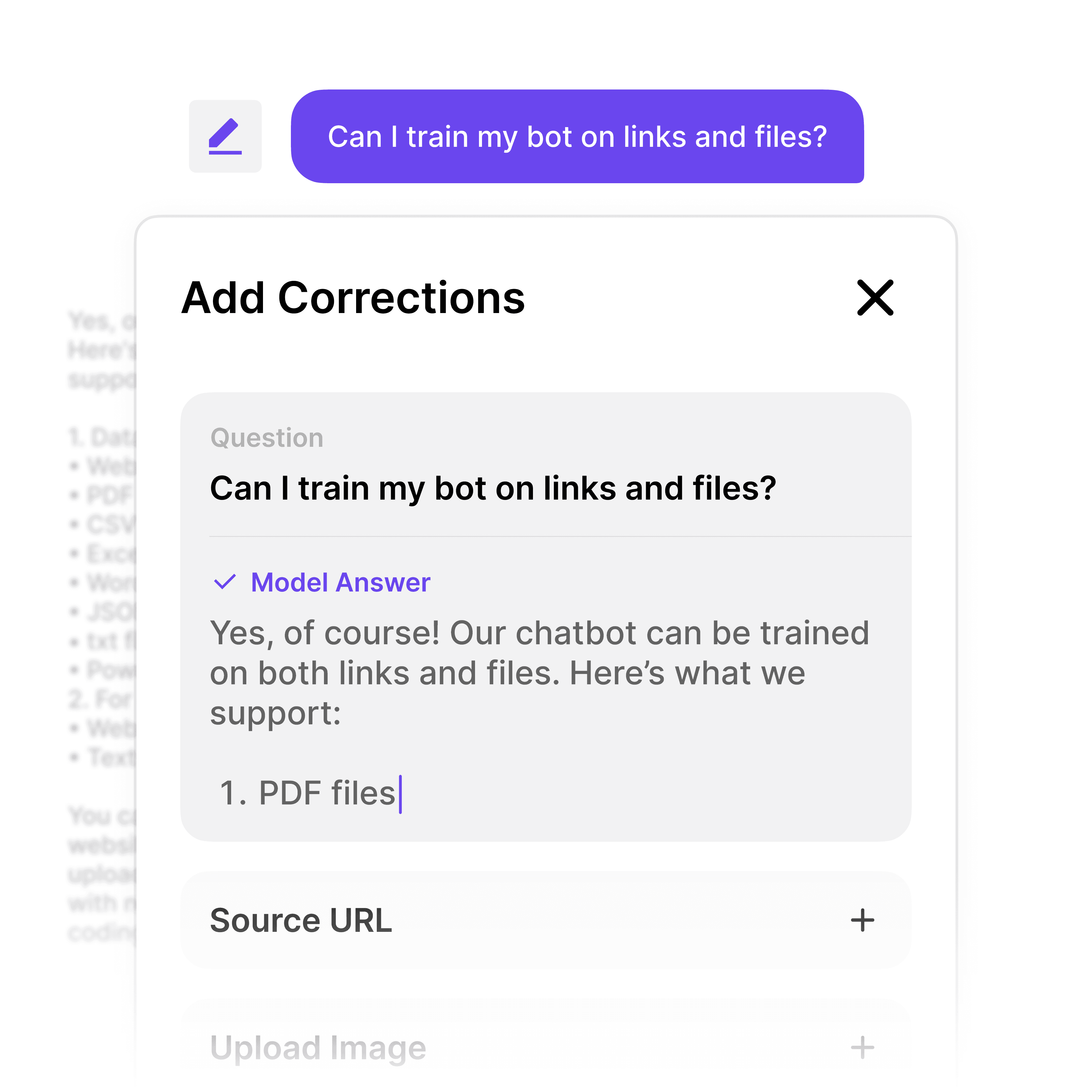

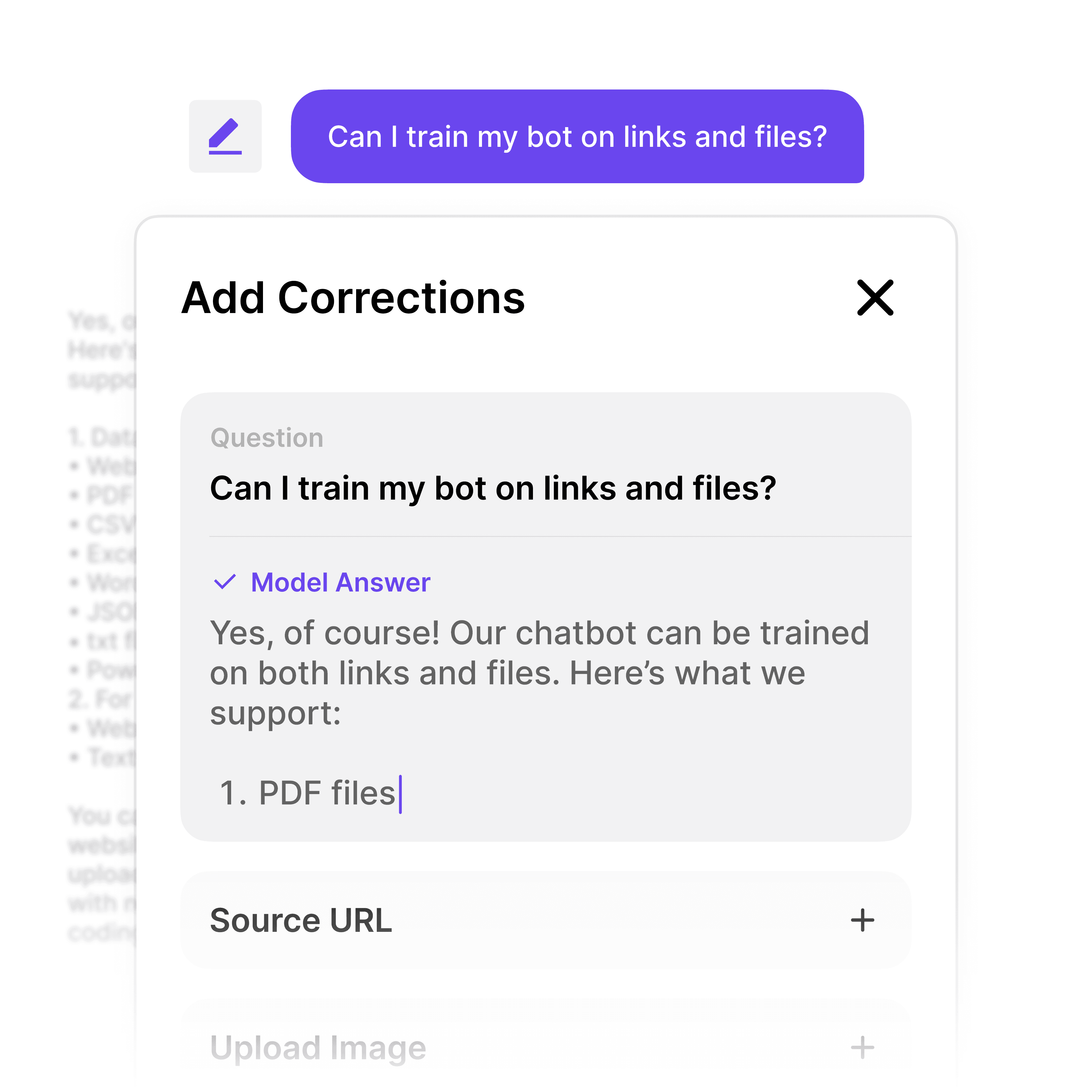

Accuracy in Financial Advice

Eliminate AI Hallucinations

In financial services, incorrect information can have serious consequences. Wonderchat's correction system ensures responses are accurate, sourced, and continuously improved through both automated and human verification.

Source-verified answers

Continuous improvement

Human oversight capability

Accuracy in Financial Advice

Eliminate AI Hallucinations

In financial services, incorrect information can have serious consequences. Wonderchat's correction system ensures responses are accurate, sourced, and continuously improved through both automated and human verification.

Source-verified answers

Continuous improvement

Human oversight capability

Accuracy in Financial Advice

Eliminate AI Hallucinations

In financial services, incorrect information can have serious consequences. Wonderchat's correction system ensures responses are accurate, sourced, and continuously improved through both automated and human verification.

Source-verified answers

Continuous improvement

Human oversight capability

5-minute set up with our native integration

Deploy Your Financial Chatbot in Minutes

1

Create your AI chatbot – Pick the perfect AI model fit for your support needs.

2

Train AI with Docs, FAQs & Policies – Upload knowledge base files and site links.

3

Customise Workflows & Escalation Rules – AI handles what it can, and escalates what it can’t.

4

Monitor & Optimise with Analytics – See where customers get stuck and fine-tune responses.

Performance Tracking

Analytics for Compliance Monitoring

Track every interaction to ensure your chatbot meets financial compliance standards. Identify knowledge gaps, monitor resolution rates, and gain insights into customer inquiries to optimize performance.

Compliance tracking

Query pattern analysis

Performance metrics

Performance Tracking

Analytics for Compliance Monitoring

Track every interaction to ensure your chatbot meets financial compliance standards. Identify knowledge gaps, monitor resolution rates, and gain insights into customer inquiries to optimize performance.

Compliance tracking

Query pattern analysis

Performance metrics

Performance Tracking

Analytics for Compliance Monitoring

Track every interaction to ensure your chatbot meets financial compliance standards. Identify knowledge gaps, monitor resolution rates, and gain insights into customer inquiries to optimize performance.

Compliance tracking

Query pattern analysis

Performance metrics

Complex Financial Questions

Seamless Escalation to Advisors

When financial inquiries require human expertise, Wonderchat ensures smooth transition to your financial advisors. Collect necessary customer details and route conversations to the appropriate specialist.

Intelligent routing system

Contextual handover

Conversation continuity

Complex Financial Questions

Seamless Escalation to Advisors

When financial inquiries require human expertise, Wonderchat ensures smooth transition to your financial advisors. Collect necessary customer details and route conversations to the appropriate specialist.

Intelligent routing system

Contextual handover

Conversation continuity

Complex Financial Questions

Seamless Escalation to Advisors

When financial inquiries require human expertise, Wonderchat ensures smooth transition to your financial advisors. Collect necessary customer details and route conversations to the appropriate specialist.

Intelligent routing system

Contextual handover

Conversation continuity

40+ Languages

Starts at $0.02/message

Available 24/7

Request Your Financial Chatbot Demo

14-day free trial. No credit card required

Testimonials

Businesses with successful customer service start

with Wonderchat

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

Industry Grade Compliance

Wonderchat is GDPR compliant and AICPA SOC 2 Certified.

FAQ

How does Wonderchat ensure financial compliance?

Wonderchat ensures financial compliance through multiple layers of protection. Our platform is SOC 2 and GDPR compliant, providing enterprise-grade security for sensitive financial data. The chatbot only provides answers based on your approved financial documentation, with source attribution for every response. This verifiable approach eliminates AI hallucinations that could lead to compliance violations. Additionally, our analytics dashboard allows compliance teams to monitor all interactions and maintain oversight of customer communications.

Can the chatbot handle complex financial product inquiries?

Yes, Wonderchat excels at handling complex financial product inquiries. The AI is trained specifically on your financial products, policies, and documentation, allowing it to accurately answer detailed questions about loan terms, investment options, account types, fees, and eligibility requirements. For particularly complex scenarios, the system includes smooth escalation pathways to human financial advisors. The chatbot can collect relevant information before transferring the conversation, ensuring your specialists have the context they need to provide personalized assistance.

How quickly can we implement a financial institution chatbot?

Financial institutions can implement a Wonderchat chatbot in as little as 5 minutes for basic functionality. The no-code platform allows you to quickly upload your financial documentation, connect to existing knowledge bases, or crawl your website to train the AI. For more comprehensive enterprise implementations with custom integrations to internal systems, the timeline typically extends to a few weeks. Our team works closely with your compliance, IT, and customer service departments to ensure seamless integration with your existing infrastructure and adherence to all regulatory requirements.

Can Wonderchat integrate with our existing banking systems?

Yes, Wonderchat offers robust integration capabilities with existing banking and financial systems. Our platform can connect to your CRM, helpdesk, and communication tools through native integrations or our comprehensive API/SDK. This allows the chatbot to access customer information (with proper authentication), check account status, or create support tickets in your existing systems. For enterprise clients, we offer custom integrations with proprietary banking platforms and internal databases, ensuring the chatbot functions as a seamless extension of your financial technology ecosystem.

How does the chatbot protect customer financial data?

Protecting customer financial data is our highest priority. Wonderchat's enterprise-grade security includes SOC 2 and GDPR compliance, ensuring all interactions meet stringent data protection standards. Our platform employs end-to-end encryption for all communications, role-based access controls for administrative functions, and secure authentication protocols. We never store sensitive customer financial information unless explicitly configured to do so, and all data handling practices are transparent and configurable to meet your institution's specific compliance requirements and data retention policies.

Can the chatbot help with regulatory reporting requirements?

Yes, Wonderchat can assist with regulatory reporting requirements through comprehensive analytics and logging capabilities. The platform maintains detailed records of all customer interactions, which can be valuable for demonstrating compliance with regulatory requirements around customer communications. The analytics dashboard provides insights into common customer inquiries, resolution rates, and escalation patterns. This data can help identify potential compliance issues proactively and provide documentation for regulatory audits. However, the specific regulatory reporting features should be configured in consultation with your compliance team to ensure they meet your institution's particular requirements.

FAQ

How does Wonderchat ensure financial compliance?

Wonderchat ensures financial compliance through multiple layers of protection. Our platform is SOC 2 and GDPR compliant, providing enterprise-grade security for sensitive financial data. The chatbot only provides answers based on your approved financial documentation, with source attribution for every response. This verifiable approach eliminates AI hallucinations that could lead to compliance violations. Additionally, our analytics dashboard allows compliance teams to monitor all interactions and maintain oversight of customer communications.

Can the chatbot handle complex financial product inquiries?

Yes, Wonderchat excels at handling complex financial product inquiries. The AI is trained specifically on your financial products, policies, and documentation, allowing it to accurately answer detailed questions about loan terms, investment options, account types, fees, and eligibility requirements. For particularly complex scenarios, the system includes smooth escalation pathways to human financial advisors. The chatbot can collect relevant information before transferring the conversation, ensuring your specialists have the context they need to provide personalized assistance.

How quickly can we implement a financial institution chatbot?

Financial institutions can implement a Wonderchat chatbot in as little as 5 minutes for basic functionality. The no-code platform allows you to quickly upload your financial documentation, connect to existing knowledge bases, or crawl your website to train the AI. For more comprehensive enterprise implementations with custom integrations to internal systems, the timeline typically extends to a few weeks. Our team works closely with your compliance, IT, and customer service departments to ensure seamless integration with your existing infrastructure and adherence to all regulatory requirements.

Can Wonderchat integrate with our existing banking systems?

Yes, Wonderchat offers robust integration capabilities with existing banking and financial systems. Our platform can connect to your CRM, helpdesk, and communication tools through native integrations or our comprehensive API/SDK. This allows the chatbot to access customer information (with proper authentication), check account status, or create support tickets in your existing systems. For enterprise clients, we offer custom integrations with proprietary banking platforms and internal databases, ensuring the chatbot functions as a seamless extension of your financial technology ecosystem.

How does the chatbot protect customer financial data?

Protecting customer financial data is our highest priority. Wonderchat's enterprise-grade security includes SOC 2 and GDPR compliance, ensuring all interactions meet stringent data protection standards. Our platform employs end-to-end encryption for all communications, role-based access controls for administrative functions, and secure authentication protocols. We never store sensitive customer financial information unless explicitly configured to do so, and all data handling practices are transparent and configurable to meet your institution's specific compliance requirements and data retention policies.

Can the chatbot help with regulatory reporting requirements?

Yes, Wonderchat can assist with regulatory reporting requirements through comprehensive analytics and logging capabilities. The platform maintains detailed records of all customer interactions, which can be valuable for demonstrating compliance with regulatory requirements around customer communications. The analytics dashboard provides insights into common customer inquiries, resolution rates, and escalation patterns. This data can help identify potential compliance issues proactively and provide documentation for regulatory audits. However, the specific regulatory reporting features should be configured in consultation with your compliance team to ensure they meet your institution's particular requirements.

FAQ

How does Wonderchat ensure financial compliance?

Wonderchat ensures financial compliance through multiple layers of protection. Our platform is SOC 2 and GDPR compliant, providing enterprise-grade security for sensitive financial data. The chatbot only provides answers based on your approved financial documentation, with source attribution for every response. This verifiable approach eliminates AI hallucinations that could lead to compliance violations. Additionally, our analytics dashboard allows compliance teams to monitor all interactions and maintain oversight of customer communications.

Can the chatbot handle complex financial product inquiries?

Yes, Wonderchat excels at handling complex financial product inquiries. The AI is trained specifically on your financial products, policies, and documentation, allowing it to accurately answer detailed questions about loan terms, investment options, account types, fees, and eligibility requirements. For particularly complex scenarios, the system includes smooth escalation pathways to human financial advisors. The chatbot can collect relevant information before transferring the conversation, ensuring your specialists have the context they need to provide personalized assistance.

How quickly can we implement a financial institution chatbot?

Financial institutions can implement a Wonderchat chatbot in as little as 5 minutes for basic functionality. The no-code platform allows you to quickly upload your financial documentation, connect to existing knowledge bases, or crawl your website to train the AI. For more comprehensive enterprise implementations with custom integrations to internal systems, the timeline typically extends to a few weeks. Our team works closely with your compliance, IT, and customer service departments to ensure seamless integration with your existing infrastructure and adherence to all regulatory requirements.

Can Wonderchat integrate with our existing banking systems?

Yes, Wonderchat offers robust integration capabilities with existing banking and financial systems. Our platform can connect to your CRM, helpdesk, and communication tools through native integrations or our comprehensive API/SDK. This allows the chatbot to access customer information (with proper authentication), check account status, or create support tickets in your existing systems. For enterprise clients, we offer custom integrations with proprietary banking platforms and internal databases, ensuring the chatbot functions as a seamless extension of your financial technology ecosystem.

How does the chatbot protect customer financial data?

Protecting customer financial data is our highest priority. Wonderchat's enterprise-grade security includes SOC 2 and GDPR compliance, ensuring all interactions meet stringent data protection standards. Our platform employs end-to-end encryption for all communications, role-based access controls for administrative functions, and secure authentication protocols. We never store sensitive customer financial information unless explicitly configured to do so, and all data handling practices are transparent and configurable to meet your institution's specific compliance requirements and data retention policies.

Can the chatbot help with regulatory reporting requirements?

Yes, Wonderchat can assist with regulatory reporting requirements through comprehensive analytics and logging capabilities. The platform maintains detailed records of all customer interactions, which can be valuable for demonstrating compliance with regulatory requirements around customer communications. The analytics dashboard provides insights into common customer inquiries, resolution rates, and escalation patterns. This data can help identify potential compliance issues proactively and provide documentation for regulatory audits. However, the specific regulatory reporting features should be configured in consultation with your compliance team to ensure they meet your institution's particular requirements.

40+ Languages

Starts at $0.02/message

Available 24/7

Request Your Financial Chatbot Demo

14-day free trial. No credit card required

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited