Chatbot for Insurance: Build Trust with Source-Cited AI

Deploy an AI chatbot for insurance trained on your policy documents. Wonderchat delivers instant, verifiable answers 24/7 to build customer trust and maintain regulatory compliance.

Trusted by businesses worldwide

Why Insurance Companies Need AI Chatbots

Insurance agents spend countless hours answering repetitive policy questions instead of closing sales. Meanwhile, customers grow frustrated waiting for simple answers about coverage and claims. Wonderchat's AI chatbot for insurance transforms this dynamic by instantly answering policy questions with verifiable, source-cited information. Your customers get immediate, accurate responses while your agents focus on high-value interactions. With no coding required, you can train the AI on your specific policies, FAQs, and product documentation to ensure compliance while delivering 24/7 customer service.

Emily

AI Agent

Wonderbot

Welcome to Wonderchat! How can I help you today?

hey i’d like to upgrade to enterprise please

Wonderbot

Sure, please hold on for a second.

Retrieving account details...

Retrieving account details...

Please confirm that you would like to upgrade to Wonderchat Enterprise. Your Visa card ending in 1234 will be charged $480.00 a year.

Cancel

Upgrade

Message...

Easy 5 minute set-up

How Wonderchat Works

Regulatory Compliance Guaranteed

Enterprise-Grade Security & Compliance

Meet strict insurance industry regulations with Wonderchat's GDPR and SOC 2 compliant platform. Handle sensitive policyholder information with confidence while maintaining full regulatory compliance.

SOC 2 certified

GDPR compliant

Secure data handling

Regulatory Compliance Guaranteed

Enterprise-Grade Security & Compliance

Meet strict insurance industry regulations with Wonderchat's GDPR and SOC 2 compliant platform. Handle sensitive policyholder information with confidence while maintaining full regulatory compliance.

SOC 2 certified

GDPR compliant

Secure data handling

Regulatory Compliance Guaranteed

Enterprise-Grade Security & Compliance

Meet strict insurance industry regulations with Wonderchat's GDPR and SOC 2 compliant platform. Handle sensitive policyholder information with confidence while maintaining full regulatory compliance.

SOC 2 certified

GDPR compliant

Secure data handling

Policy Document Integration

Train AI on Your Insurance Documents

Quickly create an insurance chatbot by uploading policy PDFs, coverage documents, and claim procedures. Your AI agent will understand complex policy terms and provide accurate information to policyholders.

Upload policy PDFs

Crawl insurance websites

Sync help desk articles

Policy Document Integration

Train AI on Your Insurance Documents

Quickly create an insurance chatbot by uploading policy PDFs, coverage documents, and claim procedures. Your AI agent will understand complex policy terms and provide accurate information to policyholders.

Upload policy PDFs

Crawl insurance websites

Sync help desk articles

Policy Document Integration

Train AI on Your Insurance Documents

Quickly create an insurance chatbot by uploading policy PDFs, coverage documents, and claim procedures. Your AI agent will understand complex policy terms and provide accurate information to policyholders.

Upload policy PDFs

Crawl insurance websites

Sync help desk articles

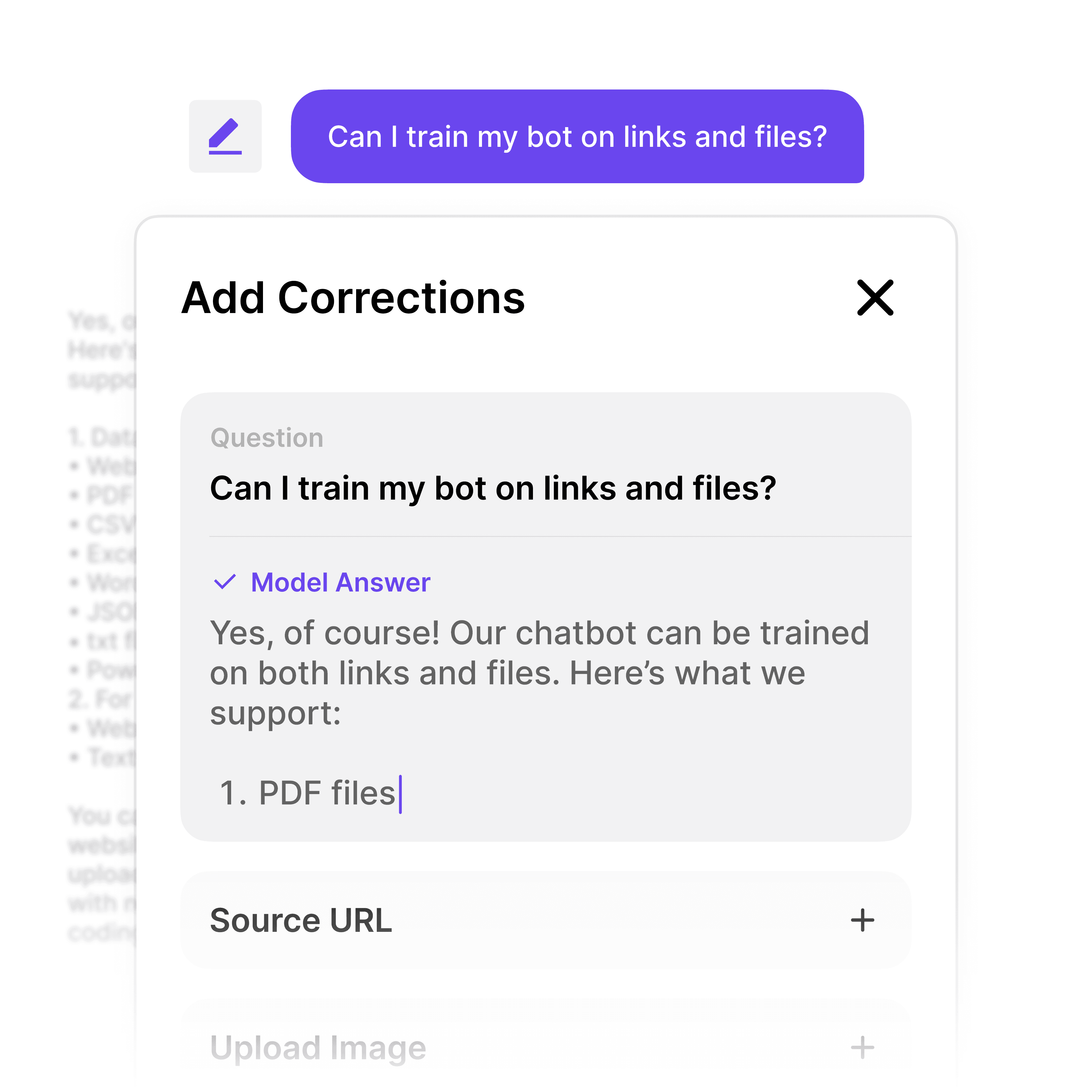

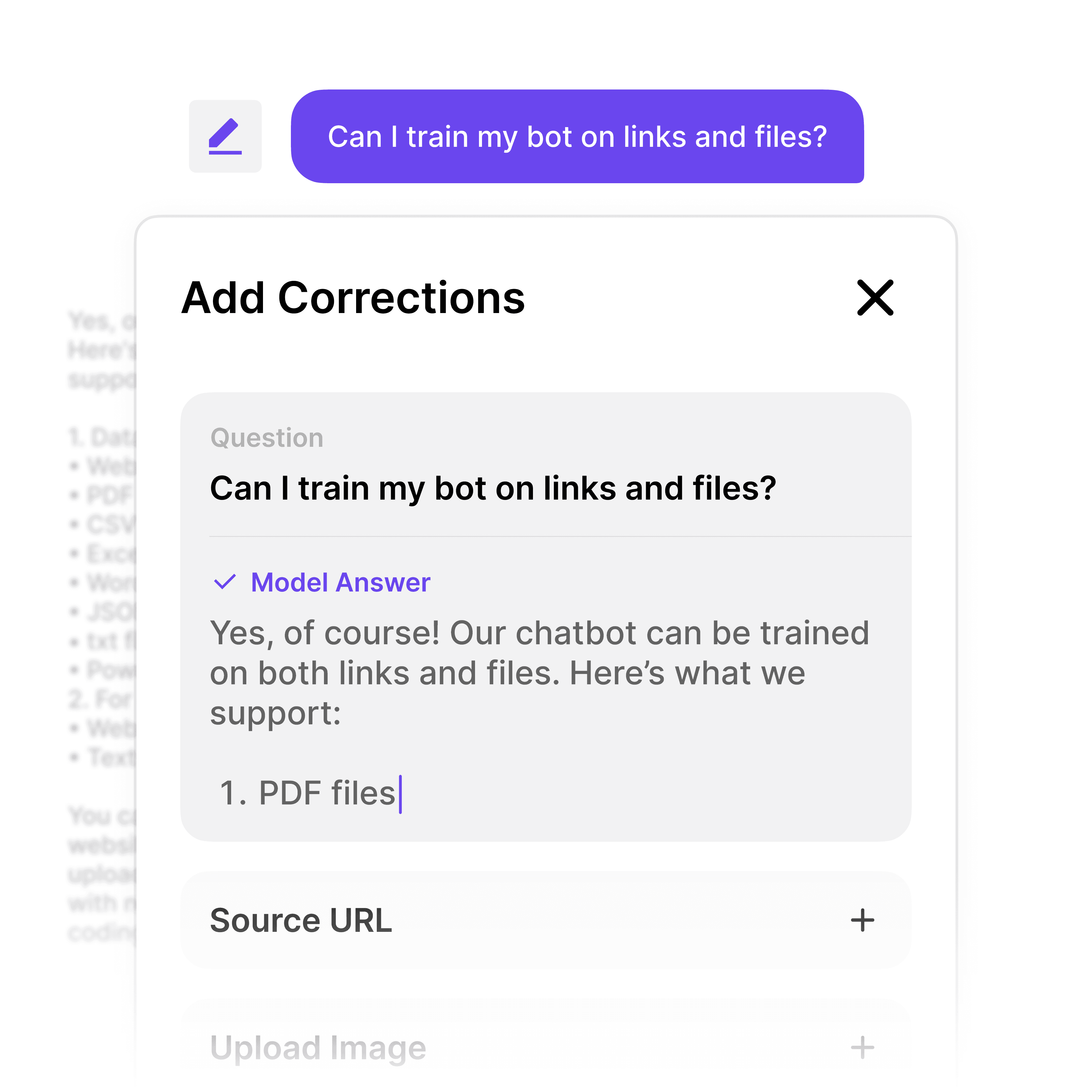

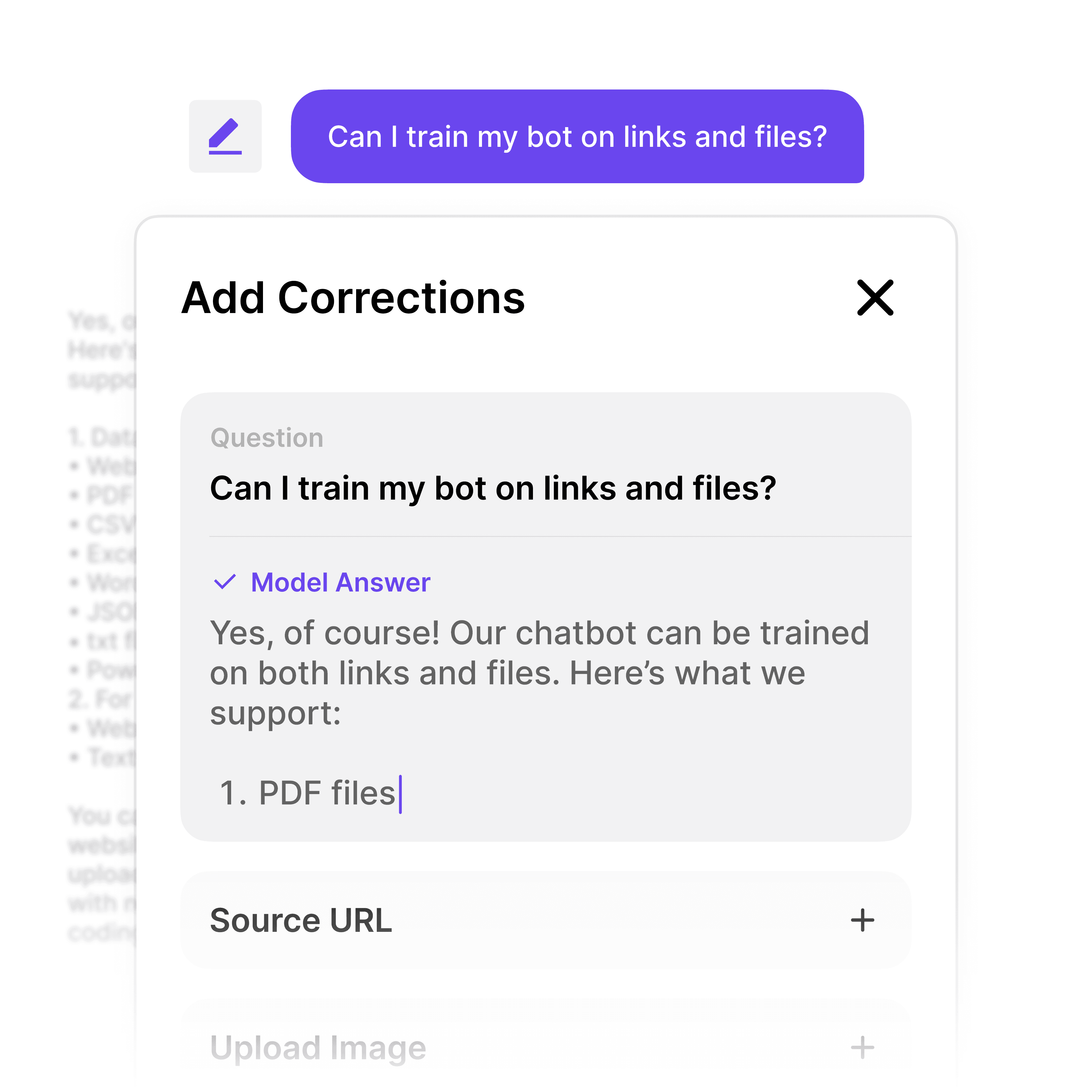

Accuracy in Every Interaction

Prevent Misinformation with Source Citations

Eliminate AI hallucinations with Wonderchat's source-attribution technology. Every answer is verifiable with direct citations to your policy documents, building trust with policyholders and ensuring compliance.

Source-cited answers

Eliminate AI hallucinations

Continuous learning

Accuracy in Every Interaction

Prevent Misinformation with Source Citations

Eliminate AI hallucinations with Wonderchat's source-attribution technology. Every answer is verifiable with direct citations to your policy documents, building trust with policyholders and ensuring compliance.

Source-cited answers

Eliminate AI hallucinations

Continuous learning

Accuracy in Every Interaction

Prevent Misinformation with Source Citations

Eliminate AI hallucinations with Wonderchat's source-attribution technology. Every answer is verifiable with direct citations to your policy documents, building trust with policyholders and ensuring compliance.

Source-cited answers

Eliminate AI hallucinations

Continuous learning

5-minute set up with our native integration

Set Up Your Insurance Chatbot in Minutes

1

Create your AI chatbot – Pick the perfect AI model fit for your support needs.

2

Train AI with Docs, FAQs & Policies – Upload knowledge base files and site links.

3

Customise Workflows & Escalation Rules – AI handles what it can, and escalates what it can’t.

4

Monitor & Optimise with Analytics – See where customers get stuck and fine-tune responses.

Insurance Lead Generation

Capture and Qualify Insurance Leads

Convert website visitors into qualified leads with automated conversation workflows. Collect prospect information, qualify leads based on coverage needs, and book consultations directly through your chatbot.

Collect contact details

Qualify insurance prospects

Book agent consultations

Insurance Lead Generation

Capture and Qualify Insurance Leads

Convert website visitors into qualified leads with automated conversation workflows. Collect prospect information, qualify leads based on coverage needs, and book consultations directly through your chatbot.

Collect contact details

Qualify insurance prospects

Book agent consultations

Insurance Lead Generation

Capture and Qualify Insurance Leads

Convert website visitors into qualified leads with automated conversation workflows. Collect prospect information, qualify leads based on coverage needs, and book consultations directly through your chatbot.

Collect contact details

Qualify insurance prospects

Book agent consultations

Seamless Agent Escalation

Smooth Handoff to Insurance Agents

When complex insurance questions arise, the chatbot seamlessly transfers the conversation to your agents. All context and policyholder information is preserved, ensuring a smooth customer experience.

Preserve conversation context

Email or live handoff

Smart routing options

Seamless Agent Escalation

Smooth Handoff to Insurance Agents

When complex insurance questions arise, the chatbot seamlessly transfers the conversation to your agents. All context and policyholder information is preserved, ensuring a smooth customer experience.

Preserve conversation context

Email or live handoff

Smart routing options

Seamless Agent Escalation

Smooth Handoff to Insurance Agents

When complex insurance questions arise, the chatbot seamlessly transfers the conversation to your agents. All context and policyholder information is preserved, ensuring a smooth customer experience.

Preserve conversation context

Email or live handoff

Smart routing options

40+ Languages

Starts at $0.02/message

Available 24/7

Deploy Your Insurance Chatbot Today

14-day free trial. No credit card required

Testimonials

Businesses with successful customer service start

with Wonderchat

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

Industry Grade Compliance

Wonderchat is GDPR compliant and AICPA SOC 2 Certified.

FAQ

How does an insurance chatbot improve customer service?

An insurance chatbot provides instant, 24/7 responses to policy questions, coverage inquiries, and claims assistance without wait times. This significantly improves customer satisfaction by eliminating hold times and providing immediate answers to common questions. Wonderchat's insurance chatbot goes further by providing source-cited answers directly from your policy documents, building trust through transparency. The system can handle up to 70% of routine inquiries, freeing your agents to focus on complex cases and sales opportunities.

Can the chatbot handle specific insurance policy questions?

Yes, Wonderchat's insurance chatbot excels at answering specific policy questions with high accuracy. By training the AI on your exact policy documents, coverage terms, exclusions, and claims procedures, it can provide precise answers to detailed inquiries. What makes Wonderchat unique is its ability to cite the exact source of information within your documents, eliminating AI hallucinations and ensuring compliance with regulatory requirements. When a customer asks about a specific coverage exclusion or policy limit, the chatbot can quote the relevant section directly from your official documents.

How do I train the chatbot on my insurance policies?

Training Wonderchat on your insurance policies is straightforward with our no-code platform. Simply upload your policy documents (PDF, DOCX, TXT), coverage guides, and claims procedures, or connect the platform to your website to automatically crawl and index your content. The system will process and understand your documents, creating a knowledge base that powers accurate responses. You can also integrate with help desk systems like Zendesk to incorporate existing support articles. The platform supports continuous updates through automatic or manual re-crawling to ensure your chatbot always has the most current policy information.

Is the insurance chatbot compliant with industry regulations?

Absolutely. Wonderchat is built with regulatory compliance as a priority. The platform is SOC 2 and GDPR compliant, making it suitable for handling sensitive policyholder information. The source-citation feature is particularly valuable for insurance compliance, as it ensures every response can be traced back to official documentation. This creates an audit trail and prevents the AI from providing inaccurate information about coverage or claims that could create liability issues. For enterprise insurance clients, we offer additional security features and compliance documentation to meet specific regulatory requirements.

Can the chatbot help generate insurance leads?

Yes, Wonderchat's insurance chatbot is a powerful lead generation tool. You can create custom conversation workflows to qualify prospects based on their insurance needs, collect contact information, and seamlessly integrate with your CRM systems like HubSpot or Salesforce. The chatbot can proactively engage website visitors, ask qualifying questions about coverage needs, and book appointments directly with agents through Calendly integration. This automation creates a 24/7 lead generation system that captures prospect information even outside business hours, ensuring you never miss an opportunity.

How does the chatbot handle complex insurance scenarios?

While Wonderchat's insurance chatbot can handle most routine policy questions, it also recognizes when a query requires human expertise. For complex scenarios like unusual claims situations or specialized coverage needs, the chatbot offers seamless handoff options. The system can collect relevant information from the customer, create a support ticket in your help desk, or directly connect the customer with an available agent. All conversation context is preserved during this handoff, so your agents have the full background and can immediately address the specific concern without asking the customer to repeat information.

FAQ

How does an insurance chatbot improve customer service?

An insurance chatbot provides instant, 24/7 responses to policy questions, coverage inquiries, and claims assistance without wait times. This significantly improves customer satisfaction by eliminating hold times and providing immediate answers to common questions. Wonderchat's insurance chatbot goes further by providing source-cited answers directly from your policy documents, building trust through transparency. The system can handle up to 70% of routine inquiries, freeing your agents to focus on complex cases and sales opportunities.

Can the chatbot handle specific insurance policy questions?

Yes, Wonderchat's insurance chatbot excels at answering specific policy questions with high accuracy. By training the AI on your exact policy documents, coverage terms, exclusions, and claims procedures, it can provide precise answers to detailed inquiries. What makes Wonderchat unique is its ability to cite the exact source of information within your documents, eliminating AI hallucinations and ensuring compliance with regulatory requirements. When a customer asks about a specific coverage exclusion or policy limit, the chatbot can quote the relevant section directly from your official documents.

How do I train the chatbot on my insurance policies?

Training Wonderchat on your insurance policies is straightforward with our no-code platform. Simply upload your policy documents (PDF, DOCX, TXT), coverage guides, and claims procedures, or connect the platform to your website to automatically crawl and index your content. The system will process and understand your documents, creating a knowledge base that powers accurate responses. You can also integrate with help desk systems like Zendesk to incorporate existing support articles. The platform supports continuous updates through automatic or manual re-crawling to ensure your chatbot always has the most current policy information.

Is the insurance chatbot compliant with industry regulations?

Absolutely. Wonderchat is built with regulatory compliance as a priority. The platform is SOC 2 and GDPR compliant, making it suitable for handling sensitive policyholder information. The source-citation feature is particularly valuable for insurance compliance, as it ensures every response can be traced back to official documentation. This creates an audit trail and prevents the AI from providing inaccurate information about coverage or claims that could create liability issues. For enterprise insurance clients, we offer additional security features and compliance documentation to meet specific regulatory requirements.

Can the chatbot help generate insurance leads?

Yes, Wonderchat's insurance chatbot is a powerful lead generation tool. You can create custom conversation workflows to qualify prospects based on their insurance needs, collect contact information, and seamlessly integrate with your CRM systems like HubSpot or Salesforce. The chatbot can proactively engage website visitors, ask qualifying questions about coverage needs, and book appointments directly with agents through Calendly integration. This automation creates a 24/7 lead generation system that captures prospect information even outside business hours, ensuring you never miss an opportunity.

How does the chatbot handle complex insurance scenarios?

While Wonderchat's insurance chatbot can handle most routine policy questions, it also recognizes when a query requires human expertise. For complex scenarios like unusual claims situations or specialized coverage needs, the chatbot offers seamless handoff options. The system can collect relevant information from the customer, create a support ticket in your help desk, or directly connect the customer with an available agent. All conversation context is preserved during this handoff, so your agents have the full background and can immediately address the specific concern without asking the customer to repeat information.

FAQ

How does an insurance chatbot improve customer service?

An insurance chatbot provides instant, 24/7 responses to policy questions, coverage inquiries, and claims assistance without wait times. This significantly improves customer satisfaction by eliminating hold times and providing immediate answers to common questions. Wonderchat's insurance chatbot goes further by providing source-cited answers directly from your policy documents, building trust through transparency. The system can handle up to 70% of routine inquiries, freeing your agents to focus on complex cases and sales opportunities.

Can the chatbot handle specific insurance policy questions?

Yes, Wonderchat's insurance chatbot excels at answering specific policy questions with high accuracy. By training the AI on your exact policy documents, coverage terms, exclusions, and claims procedures, it can provide precise answers to detailed inquiries. What makes Wonderchat unique is its ability to cite the exact source of information within your documents, eliminating AI hallucinations and ensuring compliance with regulatory requirements. When a customer asks about a specific coverage exclusion or policy limit, the chatbot can quote the relevant section directly from your official documents.

How do I train the chatbot on my insurance policies?

Training Wonderchat on your insurance policies is straightforward with our no-code platform. Simply upload your policy documents (PDF, DOCX, TXT), coverage guides, and claims procedures, or connect the platform to your website to automatically crawl and index your content. The system will process and understand your documents, creating a knowledge base that powers accurate responses. You can also integrate with help desk systems like Zendesk to incorporate existing support articles. The platform supports continuous updates through automatic or manual re-crawling to ensure your chatbot always has the most current policy information.

Is the insurance chatbot compliant with industry regulations?

Absolutely. Wonderchat is built with regulatory compliance as a priority. The platform is SOC 2 and GDPR compliant, making it suitable for handling sensitive policyholder information. The source-citation feature is particularly valuable for insurance compliance, as it ensures every response can be traced back to official documentation. This creates an audit trail and prevents the AI from providing inaccurate information about coverage or claims that could create liability issues. For enterprise insurance clients, we offer additional security features and compliance documentation to meet specific regulatory requirements.

Can the chatbot help generate insurance leads?

Yes, Wonderchat's insurance chatbot is a powerful lead generation tool. You can create custom conversation workflows to qualify prospects based on their insurance needs, collect contact information, and seamlessly integrate with your CRM systems like HubSpot or Salesforce. The chatbot can proactively engage website visitors, ask qualifying questions about coverage needs, and book appointments directly with agents through Calendly integration. This automation creates a 24/7 lead generation system that captures prospect information even outside business hours, ensuring you never miss an opportunity.

How does the chatbot handle complex insurance scenarios?

While Wonderchat's insurance chatbot can handle most routine policy questions, it also recognizes when a query requires human expertise. For complex scenarios like unusual claims situations or specialized coverage needs, the chatbot offers seamless handoff options. The system can collect relevant information from the customer, create a support ticket in your help desk, or directly connect the customer with an available agent. All conversation context is preserved during this handoff, so your agents have the full background and can immediately address the specific concern without asking the customer to repeat information.

40+ Languages

Starts at $0.02/message

Available 24/7

Deploy Your Insurance Chatbot Today

14-day free trial. No credit card required

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited