Train Financial Chatbots with Product Information

Securely train AI chatbots with your financial product data using Wonderchat's no-code platform. Deliver accurate, source-verified answers that mitigate compliance risks and enhance customer experience.

Trusted by businesses worldwide

Why Financial Institutions Choose Wonderchat

Financial services face unique challenges: complex products, strict compliance requirements, and high customer expectations for immediate, accurate information. Wonderchat provides a secure AI platform that ingests your financial product documentation, policies, and regulations to deliver verifiable, source-attributed answers. This eliminates AI hallucination risks while maintaining 24/7 availability. Our enterprise-grade solution helps financial institutions automate support for product inquiries, policy clarifications, and eligibility questions - all while maintaining compliance and data security standards.

Emily

AI Agent

Wonderbot

Welcome to Wonderchat! How can I help you today?

hey i’d like to upgrade to enterprise please

Wonderbot

Sure, please hold on for a second.

Retrieving account details...

Retrieving account details...

Please confirm that you would like to upgrade to Wonderchat Enterprise. Your Visa card ending in 1234 will be charged $480.00 a year.

Cancel

Upgrade

Message...

Easy 5 minute set-up

How Wonderchat Works

Financial Knowledge Integration

Train AI on Your Financial Data

Quickly feed your financial product documentation, compliance policies, and service information into Wonderchat. Our platform ingests websites, PDFs, and help desk content to create an AI that speaks with your financial expertise.

Website content integration

PDF document processing

Help desk knowledge sync

Financial Knowledge Integration

Train AI on Your Financial Data

Quickly feed your financial product documentation, compliance policies, and service information into Wonderchat. Our platform ingests websites, PDFs, and help desk content to create an AI that speaks with your financial expertise.

Website content integration

PDF document processing

Help desk knowledge sync

Financial Knowledge Integration

Train AI on Your Financial Data

Quickly feed your financial product documentation, compliance policies, and service information into Wonderchat. Our platform ingests websites, PDFs, and help desk content to create an AI that speaks with your financial expertise.

Website content integration

PDF document processing

Help desk knowledge sync

Regulatory Adherence

Enterprise-Grade Financial Compliance

Meet stringent financial industry requirements with Wonderchat's SOC 2 and GDPR compliant platform. Handle sensitive financial information securely while providing accurate product information to customers.

SOC 2 compliance

GDPR adherence

Secure data handling

Regulatory Adherence

Enterprise-Grade Financial Compliance

Meet stringent financial industry requirements with Wonderchat's SOC 2 and GDPR compliant platform. Handle sensitive financial information securely while providing accurate product information to customers.

SOC 2 compliance

GDPR adherence

Secure data handling

Regulatory Adherence

Enterprise-Grade Financial Compliance

Meet stringent financial industry requirements with Wonderchat's SOC 2 and GDPR compliant platform. Handle sensitive financial information securely while providing accurate product information to customers.

SOC 2 compliance

GDPR adherence

Secure data handling

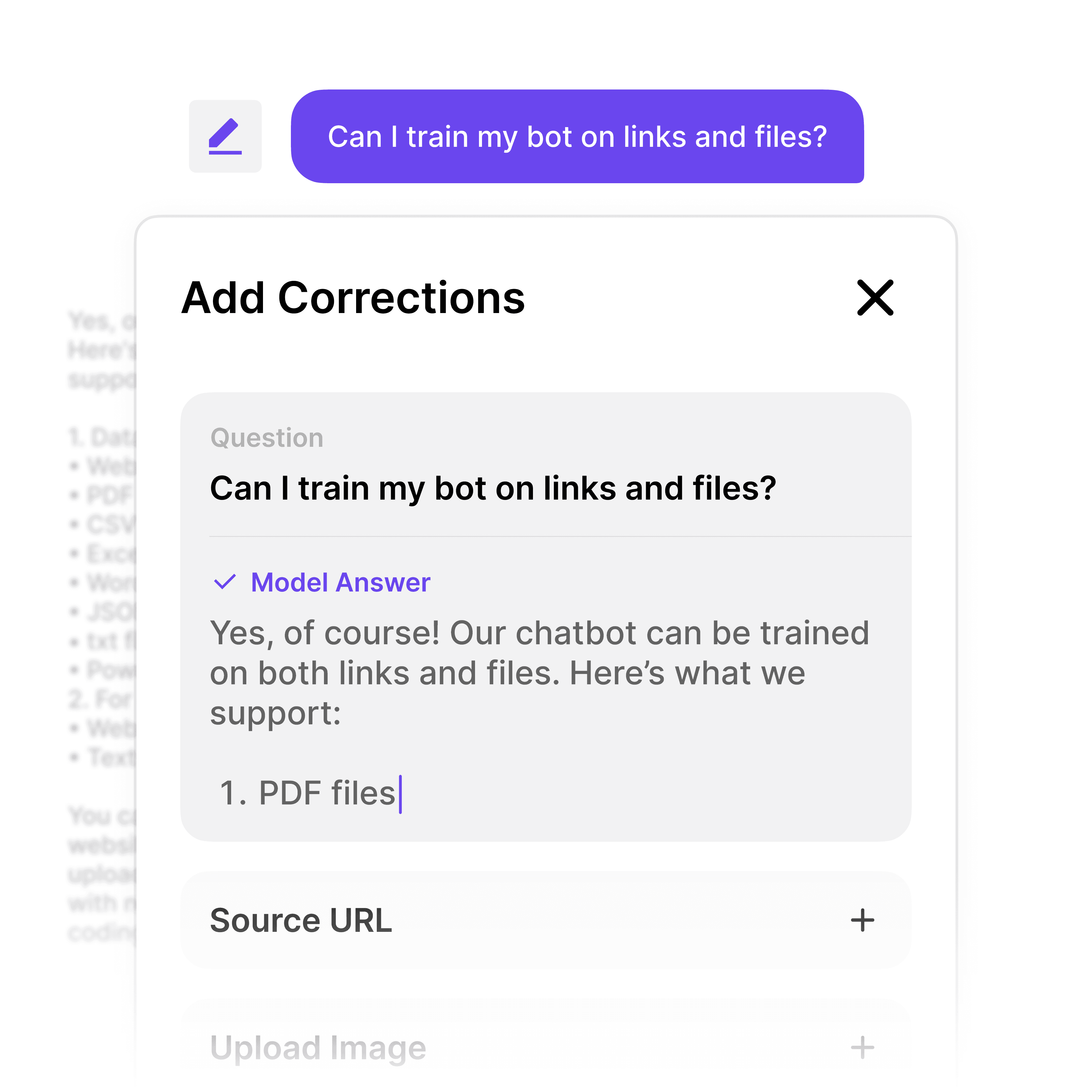

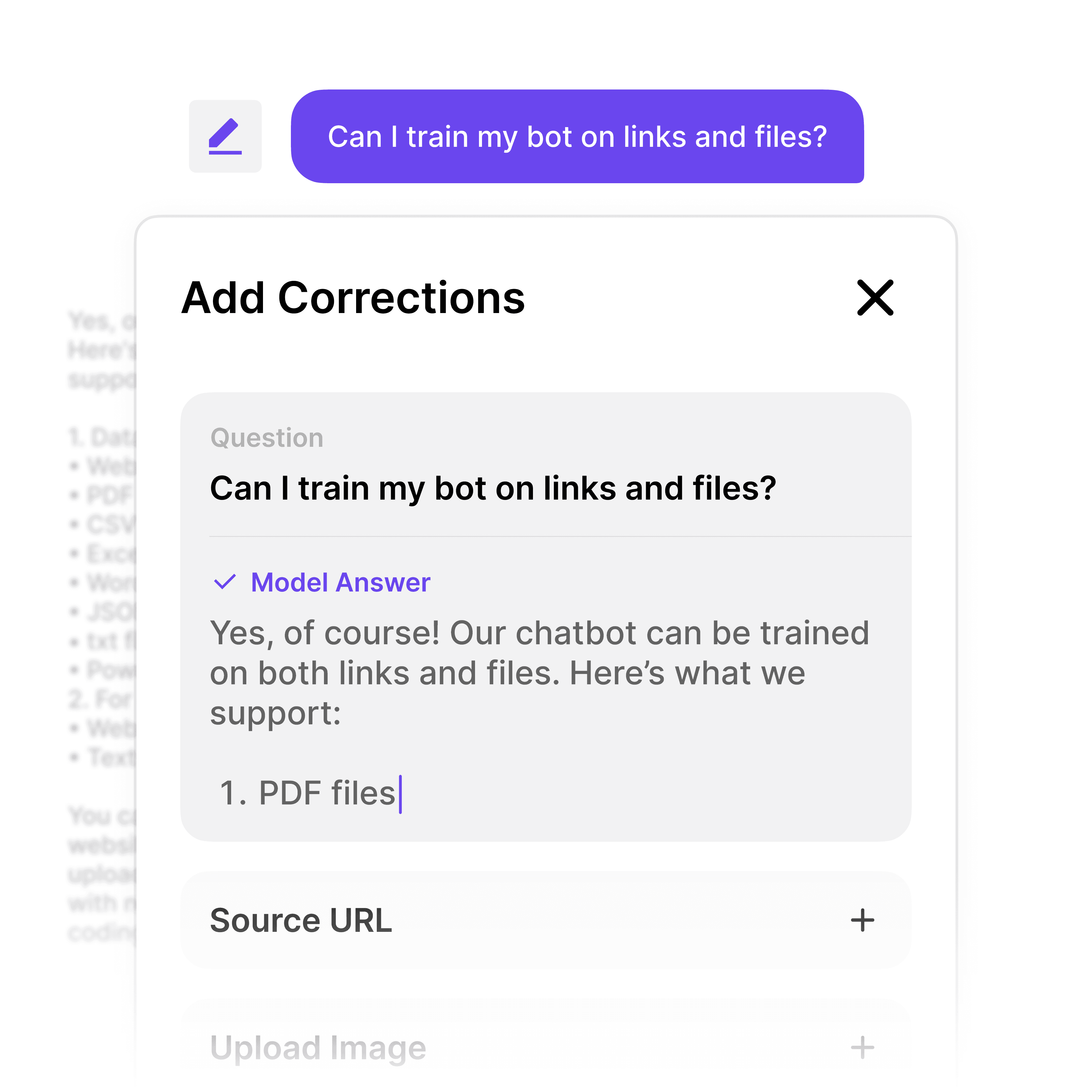

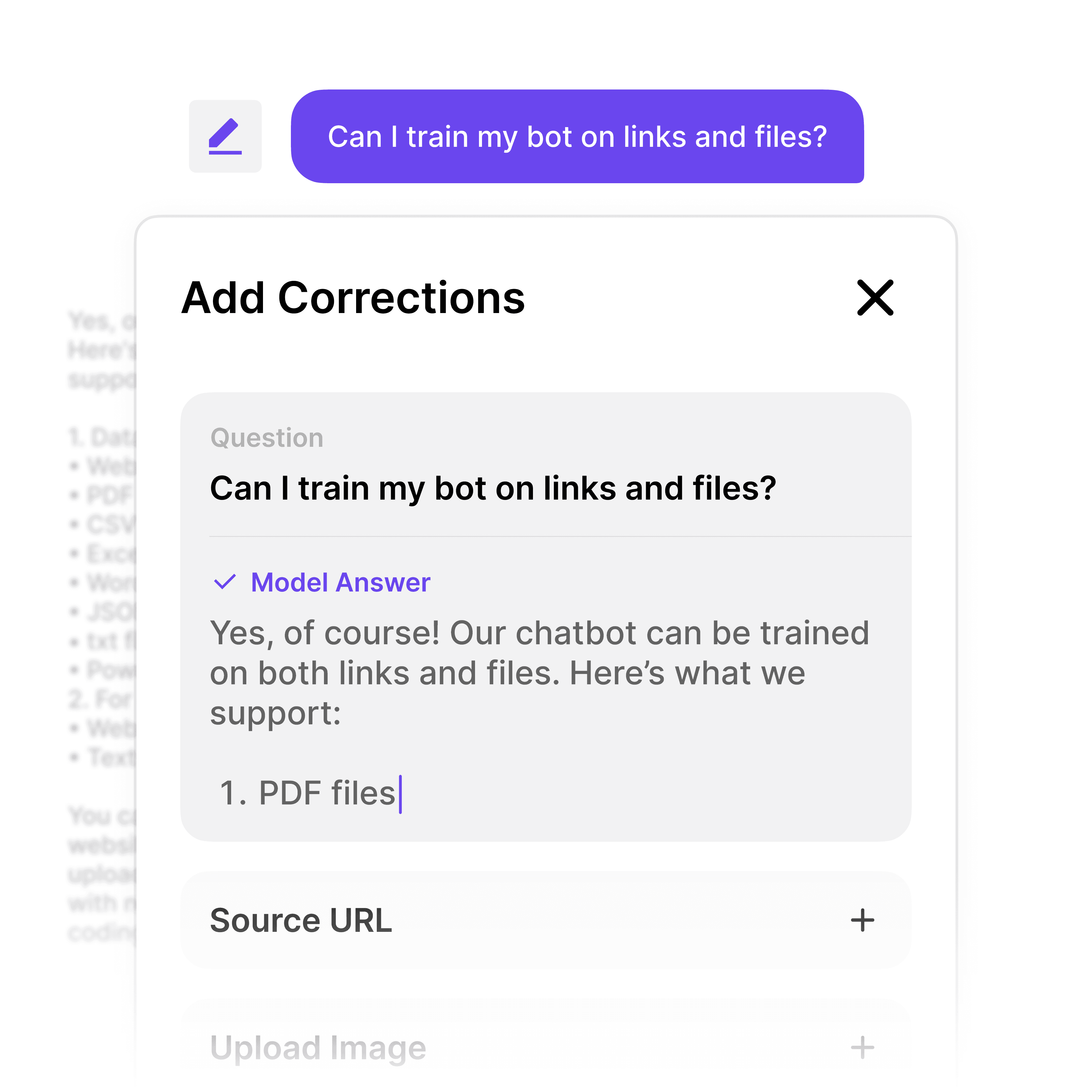

Accuracy Assurance

Prevent Financial Misinformation

Eliminate AI hallucinations that could lead to compliance risks. Wonderchat allows administrators to review, correct, and train the AI on proper financial product information, ensuring customers receive only verified answers.

Source-attributed answers

Admin oversight tools

Continuous improvement

Accuracy Assurance

Prevent Financial Misinformation

Eliminate AI hallucinations that could lead to compliance risks. Wonderchat allows administrators to review, correct, and train the AI on proper financial product information, ensuring customers receive only verified answers.

Source-attributed answers

Admin oversight tools

Continuous improvement

Accuracy Assurance

Prevent Financial Misinformation

Eliminate AI hallucinations that could lead to compliance risks. Wonderchat allows administrators to review, correct, and train the AI on proper financial product information, ensuring customers receive only verified answers.

Source-attributed answers

Admin oversight tools

Continuous improvement

5-minute set up with our native integration

Deploy Compliant Financial Chatbots in Minutes

1

Create your AI chatbot – Pick the perfect AI model fit for your support needs.

2

Train AI with Docs, FAQs & Policies – Upload knowledge base files and site links.

3

Customise Workflows & Escalation Rules – AI handles what it can, and escalates what it can’t.

4

Monitor & Optimise with Analytics – See where customers get stuck and fine-tune responses.

Comprehensive Financial Content

Index All Product Information

Wonderchat crawls and indexes your entire financial product catalog, policy documents, and compliance guidelines. This ensures the AI can instantly find accurate answers about any financial product or service you offer.

Complete content indexing

Policy document search

Product catalog integration

Comprehensive Financial Content

Index All Product Information

Wonderchat crawls and indexes your entire financial product catalog, policy documents, and compliance guidelines. This ensures the AI can instantly find accurate answers about any financial product or service you offer.

Complete content indexing

Policy document search

Product catalog integration

Comprehensive Financial Content

Index All Product Information

Wonderchat crawls and indexes your entire financial product catalog, policy documents, and compliance guidelines. This ensures the AI can instantly find accurate answers about any financial product or service you offer.

Complete content indexing

Policy document search

Product catalog integration

Escalation Pathways

Seamless Handoff to Financial Advisors

When complex financial questions arise, Wonderchat can smoothly transition customers to your human financial advisors. Collect necessary information and context before transferring to the appropriate specialist.

Context preservation

Qualified transfers

Customer journey continuity

Escalation Pathways

Seamless Handoff to Financial Advisors

When complex financial questions arise, Wonderchat can smoothly transition customers to your human financial advisors. Collect necessary information and context before transferring to the appropriate specialist.

Context preservation

Qualified transfers

Customer journey continuity

Escalation Pathways

Seamless Handoff to Financial Advisors

When complex financial questions arise, Wonderchat can smoothly transition customers to your human financial advisors. Collect necessary information and context before transferring to the appropriate specialist.

Context preservation

Qualified transfers

Customer journey continuity

40+ Languages

Starts at $0.02/message

Available 24/7

Train Your Financial Product Chatbot

14-day free trial. No credit card required

Testimonials

Businesses with successful customer service start

with Wonderchat

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

"Wonderchat has made it easier than ever to find the information I need without getting lost in the complexities. It also brings convenience and clarity to my searches."

Josh Levitsky

Global Head of Professional Services, Filewave

“Wonderchat has been a game-changer for bazuba. We’ve seen improved customer satisfaction and a noticeable boost in efficiency. Wonderchat handles our customer queries with precision and speed.

Julien Pflanzl

Web Development Lead, bazuba

“Ever since implementing Wonderchat on our site, I've seen up to a 70% reduction of customer support queries in my inbox.”

Bryce Conway

Founder and CEO, 10xTravel

"Wonderchat has given us the ability to offer real-time answers to our customer’s questions on their terms, pulling from our extensive portfolio of Insurance content. The response has been tremendous."

Ryan Hanley

Founder and President, Rogue Risk LLC

Industry Grade Compliance

Wonderchat is GDPR compliant and AICPA SOC 2 Certified.

FAQ

How does Wonderchat ensure financial compliance in chatbot responses?

Wonderchat ensures compliance through several key mechanisms. First, all responses are source-attributed, meaning every piece of information provided by the chatbot can be traced back to your approved financial documentation. Second, our continuous learning and correction features allow compliance teams to review and adjust responses to maintain regulatory adherence. Finally, our enterprise-grade security framework includes SOC 2 and GDPR compliance, ensuring that sensitive financial data remains protected while being accessible to the AI for accurate responses.

Can the chatbot handle complex financial product eligibility questions?

Yes, Wonderchat is specifically designed to handle complex eligibility questions for financial products. By training the AI on your specific eligibility criteria, terms, conditions, and regulatory requirements, the chatbot can accurately assess and communicate product suitability based on customer inputs. For more complex scenarios, the platform includes human handoff capabilities to seamlessly transition customers to financial advisors when necessary, ensuring no customer is left with incomplete information about product eligibility.

How quickly can we update the chatbot with new financial products or policy changes?

Wonderchat offers both automatic and manual re-crawling options to keep your chatbot's knowledge current with your latest financial products and policy updates. When you launch new products or make policy changes, you can immediately initiate a re-crawl of the updated content. The platform will process and integrate the new information, making it available in chatbot responses within minutes. This ensures your customers always receive the most up-to-date and accurate information about your financial offerings and policies.

What types of financial documents can be used to train the chatbot?

Wonderchat can ingest and learn from a wide variety of financial documents, including product sheets, policy manuals, disclosure documents, terms and conditions, FAQ pages, regulatory compliance documents, and internal knowledge bases. The platform supports multiple file formats such as PDF, DOCX, and TXT, as well as website content through crawling capabilities. This versatility ensures that all your financial product information, regardless of where it resides, can be incorporated into the chatbot's knowledge base.

How does Wonderchat integrate with our existing financial services systems?

Wonderchat offers extensive integration capabilities that connect seamlessly with your existing financial services infrastructure. The platform integrates with CRMs like HubSpot and Salesforce to manage customer relationships, helpdesks like Zendesk and Freshdesk for support ticket creation, and can connect to your internal knowledge bases and document management systems. For more specialized financial systems, Wonderchat provides a robust API and SDK for custom integrations, ensuring the chatbot becomes a natural extension of your existing technology ecosystem.

Can we track how customers are interacting with financial product information?

Absolutely. Wonderchat's built-in analytics dashboard provides comprehensive insights into how customers interact with your financial product information. You can track which products generate the most queries, identify common questions about specific offerings, monitor resolution rates for different types of financial inquiries, and pinpoint areas where customers might need more clarity. These actionable insights help you refine both your chatbot's responses and your financial product documentation to better serve customer needs.

FAQ

How does Wonderchat ensure financial compliance in chatbot responses?

Wonderchat ensures compliance through several key mechanisms. First, all responses are source-attributed, meaning every piece of information provided by the chatbot can be traced back to your approved financial documentation. Second, our continuous learning and correction features allow compliance teams to review and adjust responses to maintain regulatory adherence. Finally, our enterprise-grade security framework includes SOC 2 and GDPR compliance, ensuring that sensitive financial data remains protected while being accessible to the AI for accurate responses.

Can the chatbot handle complex financial product eligibility questions?

Yes, Wonderchat is specifically designed to handle complex eligibility questions for financial products. By training the AI on your specific eligibility criteria, terms, conditions, and regulatory requirements, the chatbot can accurately assess and communicate product suitability based on customer inputs. For more complex scenarios, the platform includes human handoff capabilities to seamlessly transition customers to financial advisors when necessary, ensuring no customer is left with incomplete information about product eligibility.

How quickly can we update the chatbot with new financial products or policy changes?

Wonderchat offers both automatic and manual re-crawling options to keep your chatbot's knowledge current with your latest financial products and policy updates. When you launch new products or make policy changes, you can immediately initiate a re-crawl of the updated content. The platform will process and integrate the new information, making it available in chatbot responses within minutes. This ensures your customers always receive the most up-to-date and accurate information about your financial offerings and policies.

What types of financial documents can be used to train the chatbot?

Wonderchat can ingest and learn from a wide variety of financial documents, including product sheets, policy manuals, disclosure documents, terms and conditions, FAQ pages, regulatory compliance documents, and internal knowledge bases. The platform supports multiple file formats such as PDF, DOCX, and TXT, as well as website content through crawling capabilities. This versatility ensures that all your financial product information, regardless of where it resides, can be incorporated into the chatbot's knowledge base.

How does Wonderchat integrate with our existing financial services systems?

Wonderchat offers extensive integration capabilities that connect seamlessly with your existing financial services infrastructure. The platform integrates with CRMs like HubSpot and Salesforce to manage customer relationships, helpdesks like Zendesk and Freshdesk for support ticket creation, and can connect to your internal knowledge bases and document management systems. For more specialized financial systems, Wonderchat provides a robust API and SDK for custom integrations, ensuring the chatbot becomes a natural extension of your existing technology ecosystem.

Can we track how customers are interacting with financial product information?

Absolutely. Wonderchat's built-in analytics dashboard provides comprehensive insights into how customers interact with your financial product information. You can track which products generate the most queries, identify common questions about specific offerings, monitor resolution rates for different types of financial inquiries, and pinpoint areas where customers might need more clarity. These actionable insights help you refine both your chatbot's responses and your financial product documentation to better serve customer needs.

FAQ

How does Wonderchat ensure financial compliance in chatbot responses?

Wonderchat ensures compliance through several key mechanisms. First, all responses are source-attributed, meaning every piece of information provided by the chatbot can be traced back to your approved financial documentation. Second, our continuous learning and correction features allow compliance teams to review and adjust responses to maintain regulatory adherence. Finally, our enterprise-grade security framework includes SOC 2 and GDPR compliance, ensuring that sensitive financial data remains protected while being accessible to the AI for accurate responses.

Can the chatbot handle complex financial product eligibility questions?

Yes, Wonderchat is specifically designed to handle complex eligibility questions for financial products. By training the AI on your specific eligibility criteria, terms, conditions, and regulatory requirements, the chatbot can accurately assess and communicate product suitability based on customer inputs. For more complex scenarios, the platform includes human handoff capabilities to seamlessly transition customers to financial advisors when necessary, ensuring no customer is left with incomplete information about product eligibility.

How quickly can we update the chatbot with new financial products or policy changes?

Wonderchat offers both automatic and manual re-crawling options to keep your chatbot's knowledge current with your latest financial products and policy updates. When you launch new products or make policy changes, you can immediately initiate a re-crawl of the updated content. The platform will process and integrate the new information, making it available in chatbot responses within minutes. This ensures your customers always receive the most up-to-date and accurate information about your financial offerings and policies.

What types of financial documents can be used to train the chatbot?

Wonderchat can ingest and learn from a wide variety of financial documents, including product sheets, policy manuals, disclosure documents, terms and conditions, FAQ pages, regulatory compliance documents, and internal knowledge bases. The platform supports multiple file formats such as PDF, DOCX, and TXT, as well as website content through crawling capabilities. This versatility ensures that all your financial product information, regardless of where it resides, can be incorporated into the chatbot's knowledge base.

How does Wonderchat integrate with our existing financial services systems?

Wonderchat offers extensive integration capabilities that connect seamlessly with your existing financial services infrastructure. The platform integrates with CRMs like HubSpot and Salesforce to manage customer relationships, helpdesks like Zendesk and Freshdesk for support ticket creation, and can connect to your internal knowledge bases and document management systems. For more specialized financial systems, Wonderchat provides a robust API and SDK for custom integrations, ensuring the chatbot becomes a natural extension of your existing technology ecosystem.

Can we track how customers are interacting with financial product information?

Absolutely. Wonderchat's built-in analytics dashboard provides comprehensive insights into how customers interact with your financial product information. You can track which products generate the most queries, identify common questions about specific offerings, monitor resolution rates for different types of financial inquiries, and pinpoint areas where customers might need more clarity. These actionable insights help you refine both your chatbot's responses and your financial product documentation to better serve customer needs.

40+ Languages

Starts at $0.02/message

Available 24/7

Train Your Financial Product Chatbot

14-day free trial. No credit card required

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited

The platform to build AI agents that feel human

Site

© 2025 Wonderchat Private Limited